Hello Tomorrow Global Summit is an annual event – hosted in Paris – bringing together deep tech startups, investors and ecosystem supporters. The conference always provides a great opportunity to meet like-minded members of the deep tech community and learn more about the cutting-edge technologies being built today.

The mood this year was positive, perhaps not surprising given that deep tech is now the biggest sector of VC in Europe, although much debate ensued on how to provide an environment for long-term growth before Europe can consider itself comparable with the US.

Here are five of the most prominent technology areas being discussed and some interesting startups we met within each category.

Data centre tech

There were a number of companies tackling the demand for higher bandwidth and more energy-efficient optical interconnect for data centres: innovative modulation schemes (Phanofi), all-optical transceiver chips (NEW Photonics) and novel end-end optical networking (Astrape Networks).

Novel compute

Whilst there were a handful of companies within the quantum compute space, there were surprisingly few tackling novel compute. Two of note were Literal Labs (formerly Mignon) with their Tsetlin machine approach to AI, and Nanomation, a spinout from Cambridge that has developed novel software for utilising nanomaterials in next-gen chipmaking, neuromorphic computing, quantum applications and biosensing.

Outside of hardware, Embedl are an interesting Swedish startup utilising neural search, pruning and other mechanisms to reduce ML model size for more efficient deployment (and performance) on edge processors.

AR/VR/XR

The AR/VR/XR space remains a target for startups and spinouts from academic research, despite the lacklustre performance of the smartglasses sector to-date (albeit with renewed interested following the launch of Apple’s Vision Pro).

Propositions ranged from Holographic Extended Reality (HXR) projection chips (Swave Photonics) for spatial computing, through ultra-bright laser-based displays enabling better use of smartglasses in sunny conditions (VitreaLab), to SPAE sensors for energy-efficient 3D scene scanning and eye/gaze tracking (VoxelSensors).

Sensing

Sensing in general was a surprisingly well-attended space with a number of deep tech startups covering a wide gamut of industrial and consumer applications.

Multispectral imaging has emerged over the past few years covering a broad range of applications based on the wavelengths supported, and the size and cost of the imaging system.

In many cases, the focus is on industrial applications and replacing (or at least complementing) existing sensing systems (LiDAR, radar, cameras) to improve performance in adverse weather conditions or harsh environments (such as mining), or for use on production lines for spotting anomalies and defects.

Spectricity is unique in this regard by targeting consumer applications in smartphones (e.g., skin health, improved colour photography etc.) as well as industrial applications in agritech and manufacturing.

Elsewhere in sensing, simple RGB camera systems are getting a boost through AI (Tripleye), and companies such as Calyo are demonstrating an ability to deliver ultra-low SWAP-C 3D imaging through novel use of Ultrasound.

3D digital twins

And finally, startups such as Blackshark.AI and AVES Reality are using satellite and other imaging data for generating hyper-realistic 3D representations of the physical world for use across a range of applications including training for autonomous vehicles, digital representations & planning for utility companies, and a number of dual use civil/military applications.

Cybersecurity innovation critical in combatting the inexorable rise in cyber threats and ransomware attacks.

Bloc invests in technology areas that underpin the future growth and prosperity of the digital age. Cybersecurity, and in particular the challenges companies face as they move operations online and into the cloud, is a growing area of importance and innovation.

The landscape for security teams is rapidly changing. Digital transformation, accelerated by Covid and remote working, is driving a rapid uptake in cloud utilisation.

Hybrid multi-cloud & remote working practises are dramatically expanding the attack surface as workforces access company IT systems from unsecured devices (home PCs, tablets) and over unsecured WLANs (home, coffee shops) thereby tearing down the single security perimeter that security teams have previously come to rely upon.

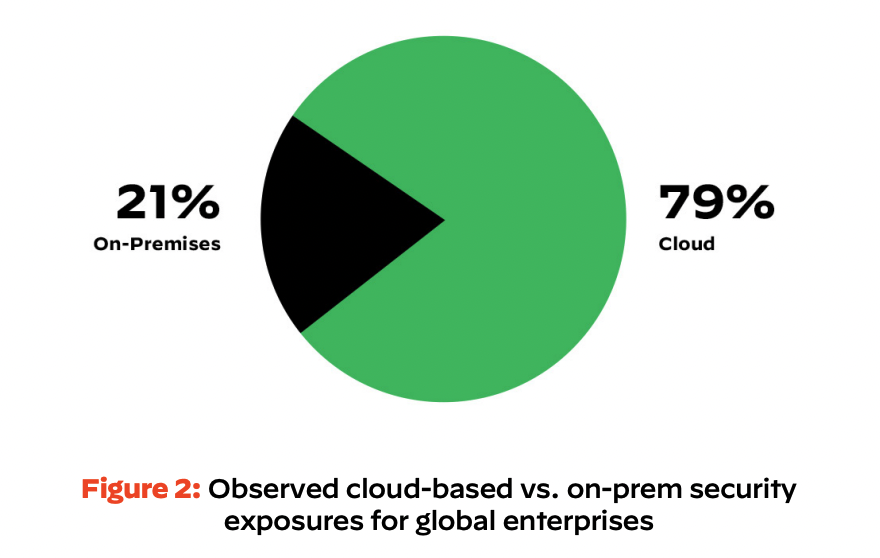

Competitive pressures driven by DevOps & CI/CD working practises are leading to mistakes in cloud configuration and deployment of unauthorised shadow IT, both of which are creating additional vulnerabilities within company networks – Verizon estimates that 82% of enterprise breaches should have been stopped by existing security controls but weren’t, and 79% of observed exposures were in the cloud compared with 21% for on-premise assets.

Worst still, zero-day vulnerabilities introduced or exploited within the systems and software of companies’ suppliers is on the rise – a Trojan horse in effect that a business has very little control over, although startups such as Darkbeam are seeking to help companies manage the risk.

Cyber-attacks and the resultant data breaches are expensive, erode customer trust, damage brand reputation and can ultimately stop a company in its tracks.

And yet despite their efforts, many companies are being overwhelmed by the magnitude of threats they face, and are ill-equipped to differentiate between real threats and false alerts coming from their networks.

Survival will be dependent on the development of intelligent tools leveraging advanced AI/ML that can augment and support security teams in their ever-lasting battle with the cybercriminals.

Key areas for innovation identified by Bloc

We have identified a number of cybersecurity areas for innovation:

- Use of few-shot learning AI techniques for detecting zero-day exploits with unknown signatures such as those introduced through supply chain attacks

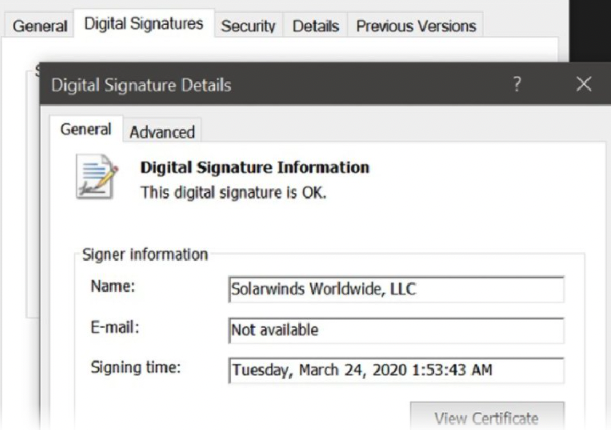

- Supply chain attacks are massively on the rise (650% annual growth) and involve cybercriminals inserting malicious code into ISV (Independent Software Vendor) products to gain access to companies downstream as was the case in the SolarWinds attack in 2020

- Methods for obfuscating existing networks to inhibit attackers without the company needing to re-architect

- Enclave Networks is one such company helping its clients to ‘darken’ their networks through the introduction of invisible network access gates

- Implementing zero-trust principles to prevent attackers from moving laterally through the network after gaining access via infected systems

- Zero-trust assumes that everyone in the network could be a bad actor, hence all activity is continuously monitored for behavioural anomalies and access to individual systems managed via granular privileges and more robust authentication methods

- Introduction of cyber deception platforms and honeytraps that lure attackers into revealing themselves thereby enabling security teams to shut them down before they cause any serious damage

- CounterCraft, for example, provide a cyber deception and counterintelligence platform designed to detect intrusion and insider threats before attacks are perpetrated

- Supporting anomaly detection at scale, especially for Industrial IoT networks comprising huge numbers of devices

- Realtime anomaly detection becomes especially challenging in the IoT space as the number of devices scale into the millions. One way to tackle this (pioneered by Shield-IoT based on work conducted within MIT) is to compress the network and resulting data into a smaller coreset enabling context-free highly accurate anomaly detection in minutes instead of hours or days

The market opportunity is clear

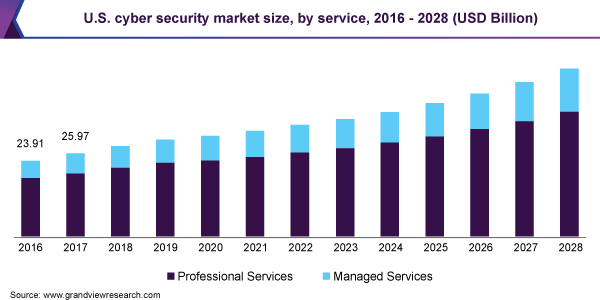

Cybersecurity software & tools in 2020 was worth $12 billion in the UK, $26.5 billion in Europe and $78 billion globally and is projected to grow to $118 billion globally by 2024. The cybersecurity market for hardware & software combined is expected to exceed $200 billion by 2024 and reach $372 billion globally by 2028.

Managing cloud vulnerabilities is a race between attacker and defender and therefore ripe for new entrants bringing fresh ideas and utilising the latest technology to deliver anomaly detection, behavioural profiling and automated tools for supporting security teams and those companies wanting to take their business operations into the cloud.

Get in touch with Bloc

We’re always looking for entrepreneurs innovating across cloud, connectivity, data science and security. Get in touch with our investment team below.