The future of AI compute is photonics… or is it?

Exploring the potential of photonics to improve efficiency in the future of compute

The science that connects our phones to cell towers remains one of the greatest technological achievements of the past century. Radio Access Networks (RAN) convert electromagnetic waves to data streams of electrons and back again at fibre-like speeds.

This is made possible through the deepest technology which takes theoretical physics out of the lab and turns it into a commercial reality. Driving the generations of technology that have become familiar household terms (the G’s) is a rich ecosystem of academia, vendors and network operators co-ordinated through standards bodies and initiatives such as ITU-R, 3GPP, GSA and GSMA.

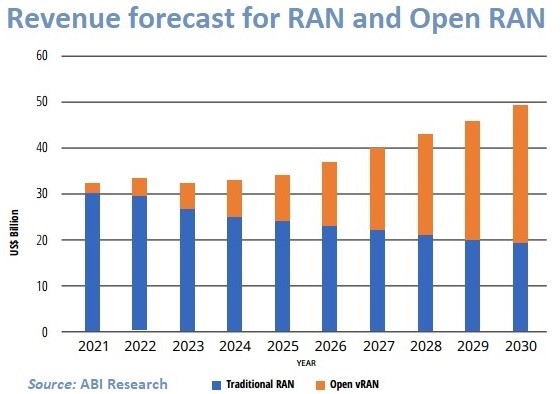

Open RAN (ORAN) is one such initiative gaining market momentum with engagement across a range of players (mobile operators, network equipment providers, chip component suppliers, system integrators, and test specialists). ORAN has moved beyond the peak of the hype-cycle and will become a major force in RAN equipment provision. Some predict it will grow from less than a tenth of total RAN spend in 2021 to over a half by 2030.

The theory of ORAN, and the driving force behind the initiative, is supply chain disruption. For Mobile Network Operators (MNOs) it provides greater flexibility, increased innovation, a broader number of suppliers whilst reducing cost through competition. Ultimately ORAN promises to break decades of vendor lock-in.

In some respects, there’s a sense of déjà vu with MNOs pushing a strategy of open interfaces between infrastructure elements to diversify supply chains.

In the early 2000s, at the peak of 3G hype, there was a broad set of infrastructure suppliers with Nokia, Ericsson, Nortel, Alcatel, Lucent, Motorola, Siemens, and Huawei all vying for business in 3G rollouts.

Even back then 3GPP standards specified intra-network element interfaces that enabled mobile networks to be built using multi-vendor products. Nokia and Ericsson developed complete end-to-end (E2E) solutions, whereas others like Motorola and Lucent concentrated on specific network elements.

But in practice, the single vendor E2E solution providers won out, the MNOs preferring a fully integrated solution as it simplified supply chains, reduced system integration overheads and streamlined Network Management. Consequently, only a small number of dominant suppliers have survived the industry consolidation that followed with the likes of Nortel, Siemens, Motorola, Alcatel and Lucent disappearing.

Valuable lessons have been learnt, this time around there is a focus on tackling proprietary product architectures and mitigating against over complicated vendor-specific Operations and Management (O&M) systems.

The O-RAN Alliance founded in 2018 by AT&T, China Mobile, Deutsche Telekom, NTT Docomo and Orange is a global community of MNOs, vendors, and research institutions working together to ensure interoperability. The Alliance has published over 74 specifications that address gaps and ambiguities within the 3GPP specifications defining the necessary O&M processes and systems.

In addition to this, security concerns about critical infrastructure being sourced predominantly from Chinese companies such as Huawei and ZTE (with implied state control) has led to Governments forcibly opening up the telecoms market by banning Chinese manufacturers from providing critical elements of 5G infrastructure. In doing so, creating a technology vacuum stimulating innovation and creating opportunity for new entrant startups – all made possible by ORAN.

A number of startups have successfully entered the market providing RF front-end solutions; examples in Europe: AccelerComm, Lime Micro, Pharrowtech, Software Radio Systems, and outside Europe: DeepSig, EdgeQ, Metanoia Communications and Picocom.

Southampton based AccelerComm is a good example of how startups can bring fresh innovation into the ORAN space – in their case, developing deep tech that delivers a 10x improvement in information throughput speeds and latency reduction.

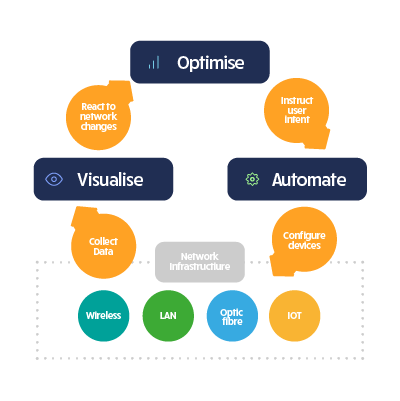

The 5G ORAN architecture also introduces the RAN intelligent controller (RIC) which allows 3rd parties to generate xApps (near real-time) or rApps (non-real time) for optimising ORAN performance based on the environment. The higher-level Management & Orchestration functions of 5G also provides opportunities for new entrants such as: Accelleran, IS-Wireless, Zeetta Networks in Europe, and from further afield Aarna Networks, Cellwize, and Opanga.

Zeetta has developed multi-domain orchestration technology based on 5G network slicing principles, and innovative splicing technology to provide QoS management and improve resource utilisation across access networks and cell sites. A capability that is especially relevant to Industry 4.0 and is demonstrated via the DCMS-backed 5G-ENCODE project.

ORAN is driving demand for higher performance compute, especially to meet the higher levels of complexity in 5G compared with 4G. Massive MIMO, in particular, can prove challenging when significant antenna arrays are used in combination with high bandwidths – Xilinx estimates a x40-x300 uplift in compute for 100MHz 64T64R 5G compared with 20MHz 8T8R 4G [source: “Telecom TV – OpenRAN Summit – October 2021”].

In response, chip suppliers are working to enrich existing CPU products with hardware accelerators to meet the demands of high-performance ORAN software whilst seeking to optimise power efficiency to enable a wider range of deployment topologies. Enter ARM and watch this space Intel.

The ORAN market will take time to become an established alternative to existing single vendor solutions especially for the high demand of dense urban high-capacity deployments. Indications are that the ORAN marketplace will mature in 2024/2025, providing an opportunity for companies to establish themselves in the short term and be well placed to capitalise on the maturity and growth phase of ORAN. ABI Research predict ORAN revenue will grow to over a half of RAN revenue by 2030.

Having said that, many MNOs will have deployed their 5G RAN equipment by this time, and ORAN may end up being more significant during a 5G equipment refresh towards the end of the decade. This is being accelerated by state intervention:

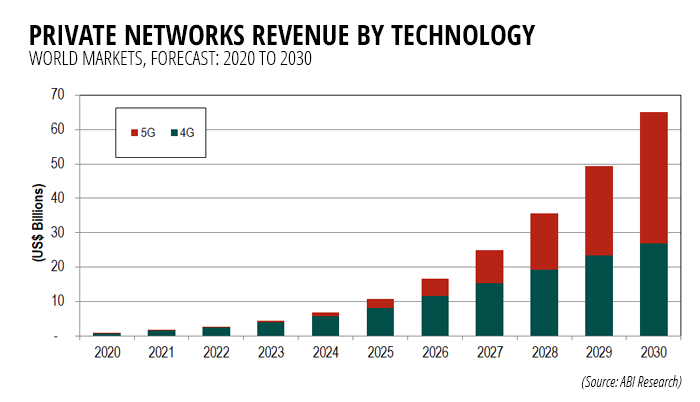

These may lead to more ORAN investments over the next 2-3 years, especially for rural areas. In the meantime, the deployment of private cellular networks (PCNs) may drive the near-term commercial opportunity for ORAN. J’son and Partners Consulting estimate that annual spending on private 4G/5G reached $1Bn in 2020, with an estimated 10% YoY growth.

Whilst this represents a sizeable market for the ORAN ecosystem, it only equates to about 2% of the total expenditure in cellular infrastructure by the MNOs, small compared to the wide-area public network opportunities in today’s market. However, strong longer-term growth in enterprise and industrial PCNs is predicted by ABI Research with revenues growing to $65Bn by 2030.

The combination of ORAN technology readiness and political stimulus are clear indicators that there’s a real opportunity for startups. Provided that is, the MNOs don’t repeat history and opt for established vendor single supplier solutions as Vodafone UK has decided to do with its selection of Samsung as its single vRAN and ORAN solution provider. BT has announced a Nokia ORAN trial in Hull and notably has been quite public that no one should assume that a single vendor strategy is going to change anytime soon.

More positively Vodafone Group has recently announced its opening an R&D centre in Spain that will work with Intel and other silicon vendors to develop its own ORAN chip architecture with half the 5 year investment of €250m coming from EU funding. Whether or not this will allow new innovators into the inner circle remains to be seen.

One of the biggest challenges for early-stage companies in telecommunications remains as much a balance sheet one as it is a technology one. How do you convince the supply chain manager of an MNO that a loss-making startup is a safe bet for its critical infrastructure?

The answer is two-fold: first deliver significant performance improvements that have economic impact. This will likely be in specialist areas that the generalist prime contractors are not agile enough, or don’t have the deep technical expertise, to address.

Such technology is likely to be very deep in the technology stack in areas such as L1 channel coding/equalisation, power efficient accelerator hardware and RF semiconductors, and at the higher layers in orchestration/resource management and QoS management using AI and Machine Learning in the RIC (xApps and rApps).

Second is to partner with and sell to the OEMs rather than MNOs. OEMs are the most obvious partners as they are also potential investors in deep tech companies.

It possibly has for Seed stage startups with a focus on 5G ORAN. But the next developments of 5G-advanced and 6G have already started, just as those have in the parallel universe of IEEE (Wi-Fi 6 and 7). So, an opportunity for early-stage investment does exist and lays in those deep dark pools of tech that will deliver on the vision to produce more efficient and cognitive networks.

We’re always looking for entrepreneurs innovating across cloud, connectivity, data science and security. Get in touch with our investment team below.

Exploring the potential of photonics to improve efficiency in the future of compute

Exploring more esoteric approaches to the future of compute