An overview of GNSS

Global Navigation Satellite Systems (GNSS) such as GPS, Galileo, GLONASS and BeiDou are constellations of satellites that transmit positioning and timing data. This data is used across an ever-widening set of consumer and commercial applications ranging from precision mapping, navigation and logistics (aerial, ground and maritime) to enable autonomous unmanned flight and driving. Such data is also fundamental to critical infrastructure through the provision of precise time (UTC) for synchronisation of telecoms, power grids, the internet and financial networks.

Whilst simple SatNav applications can be met with relatively cheap single-band GNSS receivers and patch antennas in smartphones, their positioning accuracy is limited to ~5m. Much more commercial value can be unlocked by increasing the accuracy to cm-level, thereby enabling new applications such as high precision agriculture and by improving resilience in the face of multi-path interference or poor satellite visibility to increase availability. Advanced Driver Assistance Systems (ADAS), in particular, are dependent on high precision to assist in actions such as changing lanes. And in the case of Unmanned Aerial Vehicles (UAVs) aka drones, especially those operating beyond visual line of sight (BVLoS), GNSS accuracy and resilience are equally mission critical.

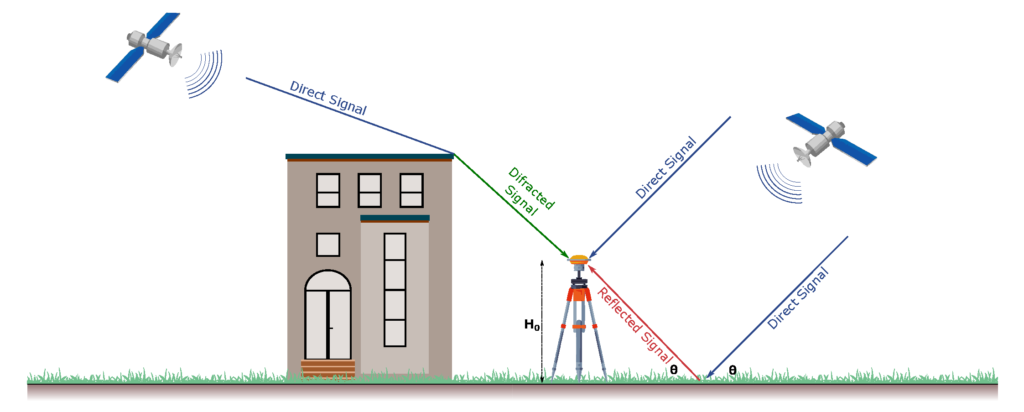

GNSS receivers need unobstructed line-of-sight to at least four satellites to generate a location fix, and even more for cm-level positioning. Buildings, bridges and trees can either block signals or cause multi-path interference thereby forcing the receiver to fallback to less-precise GNSS modes and may even lead to complete loss of signal tracking and positioning. Having access to more signals by utilising multiple GNSS bands and/or more than one GNSS constellation can make a big difference in reducing position acquisition time and improving accuracy.

Source: https://www.mdpi.com/1424-8220/22/9/3384

Interference and GNSS spoofing

Interference in the form of jamming and spoofing can be generated intentionally by bad actors, and is a growing threat. In the case of UAVs, malicious interference to jam the GNSS receiver can force the UAV to land; whilst GNSS spoofing, in which a fake signal is generated to offset the measured position, directs the UAV off its planned course to another location; the intent being to hijack the payload.

The sophistication of such attacks has historically been limited to military scenarios and been mitigated by expensive protection systems. But with the growing availability of cheap and powerful software defined radio (SDR) equipment, civil applications and critical infrastructure reliant on precise timing are equally becoming vulnerable to such attacks. As such, being able to determine the direction of incoming signals and reject those not originating from the GNSS satellites is an emerging challenge.

Importance of GNSS antennas and design considerations

GNSS signals are extremely weak, and can be as low as 1/1000th of the thermal noise. Therefore, the performance of the antenna being first in the signal processing chain, is of paramount importance to achieving high signal fidelity. This is even more important where the aim is to employ phase measurements of the carrier signal to further increase GNSS accuracy.

However, more often than not the importance of the antenna is overlooked or compromised by cost pressures, often resulting in the use of simple patch antennas. This is a mistake, as doing so dramatically increases the demands on the GNSS receiver, resulting in higher power consumption and lower performance.

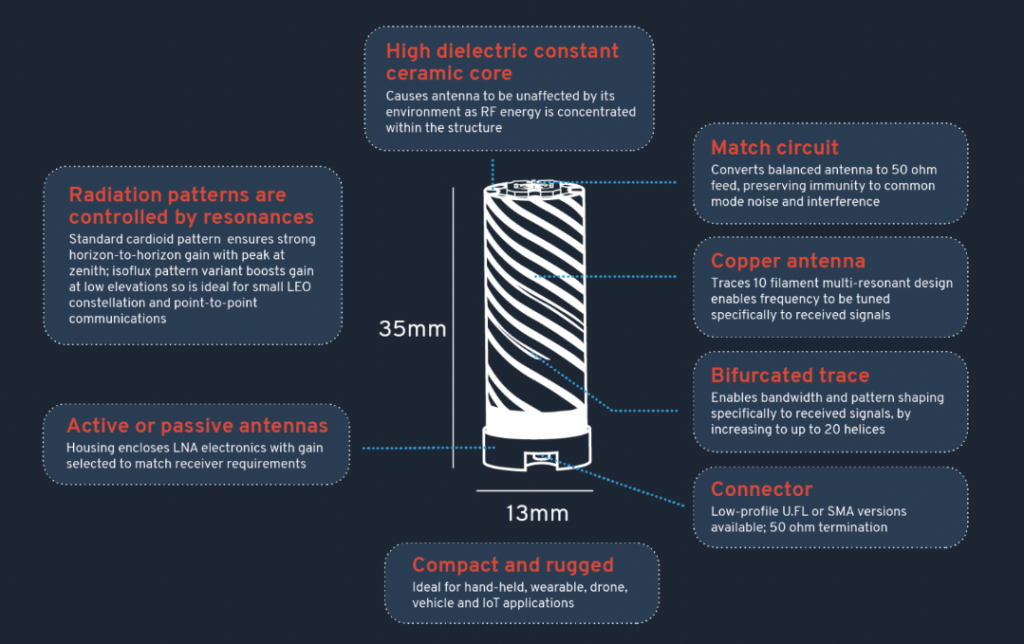

In comparison to patch antennas, a balanced helical design with its circular polarisation is capable of delivering much higher signal quality and with superior rejection of multi-path interference and common mode noise. These factors, combined with the design’s independence of ground plane effects, results in a superior antenna plus an ability to employ carrier phase measurements resulting in positional accuracy down to 10cm or better. This is simply not possible with patch antennas in typical scenarios such as on a metal vehicle roof or a drone’s wing.

The SWAP-C challenge

Size is also becoming a key issue – as GNSS becomes increasingly employed across a variety of consumer and commercial applications, there is growing demand to miniaturise GNSS receivers. Consequently, Size, Weight and Power (SWAP-C) are becoming the key factors for the system designer, as well as cost.

UAV GNSS receivers, for example, often need to employ multiple antennas to accurately determine position and heading, and support multi-band/multi-constellation to improve resiliency. But in parallel they face size and weight constraints, plus the antennas must be deployed in close proximity without suffering from near-field coupling effects or in-band interference from nearby high-speed digital electronics on the UAV. As drones get smaller (e.g. quadcopter delivery or survey drones) the SWAP-C challenge only increases further.

Aesthetics also comes into play – very similar to the mobile phone evolution from whip-lash antenna to highly integrated smartphone, the industrial designer is increasingly influencing the end design of GNSS equipment. This influence places further challenges on the RF design and particularly where design aesthetics require the antenna to be placed inside an enclosure.

The manufacturing challenge

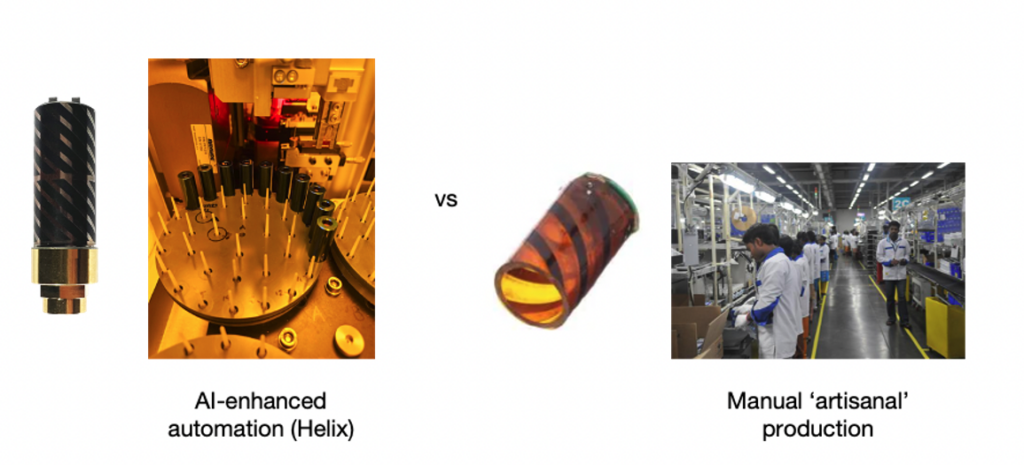

Optimal GNSS performance is achieved through the use of ceramic cores within the helical antenna. However doing so raises a number of manufacturing yield challenges. As a result of material and dimensional tolerances, the cores have a “relative dielectric mass” and so the resonance frequency can vary between units. This can lead to excessive binning in order to deliver antennas that meet the final desired RF performance. Production yield could be improved with high precision machining and tuning, but such an approach results in significantly higher production costs.

Many helical antenna manufacturers have therefore limited their designs to using air-cores to simplify production, whereby each antenna is 2D printed and folded into the 3D form of a helical antenna. This is then manually soldered and tuned, an approach which could be considered ‘artisanal’ by modern manufacturing standards. This also results in an antenna that is larger, less mechanically robust, and more expensive, and generally less performant in diverse usage scenarios.

Introducing Helix Geospace

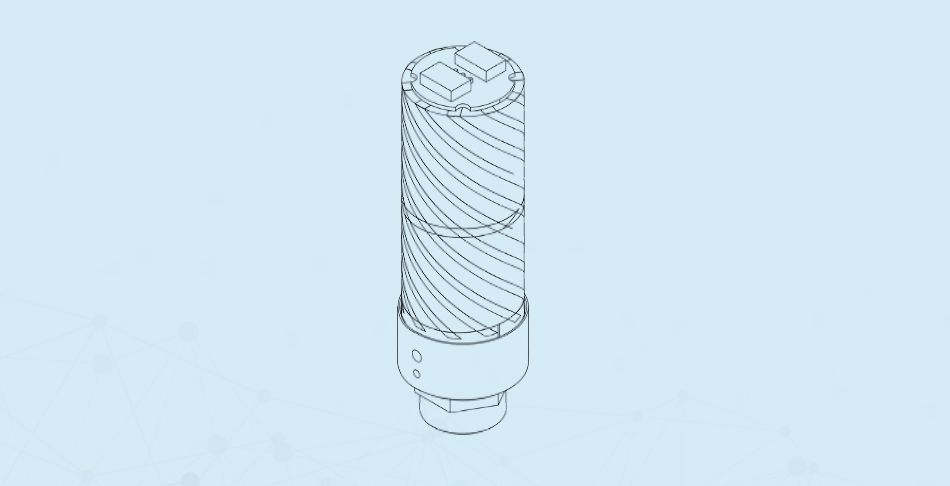

Helix Geospace excels in meeting these market needs with its 3D printed helical antennas using novel ceramics to deliver a much smaller form factor that is also electrically small thereby mitigating coupling issues. The ceramic dielectric loaded design delivers a much tighter phase centre for precise position measurements and provides a consistent radiation pattern to ensure signal fidelity and stability regardless of the satellites’ position relative to the antenna and its surroundings.

In Helix’s case, they overcome the ‘artisanal’ challenge of manufacturing through the development of an AI-driven 3D manufacturing process which automatically assesses the material variances of each ceramic core. The adaptive technology compensates by altering the helical pattern that is printed onto it, thereby enabling the production of high-performing helical antennas at volume.

This proprietary technique makes it possible to produce complex multi-band GNSS antennas on a single common dielectric core – multi-band antennas are increasingly in demand as designers seek to produce universal GNSS receiver systems for global markets. The ability to produce multi-band antennas is transformative, enabling a marginal cost of production that meets the high performance requirements of the market, but at a price point that opens up the use of helical antennas to a much wider range of price sensitive consumer and commercial applications.

In summary

As end-users and industry seek higher degrees of automation, there is growing pressure on GNSS receiver systems to evolve towards cm-level accuracy whilst maintaining high levels of resiliency, and in form factors small and light enough for widespread adoption.

By innovating in its manufacturing process, Helix is able to meet this demand with GNSS antennas that deliver a high level of performance and resilience at a price point that unlocks the widest range of consumer and commercial opportunities be that small & high precision antennas for portable applications, making cm-level accuracy a possibility within ADAS solutions, or miniaturised anti-jamming CRPA arrays suitable for mission critical UAVs as small as quadcopters (or smaller!).

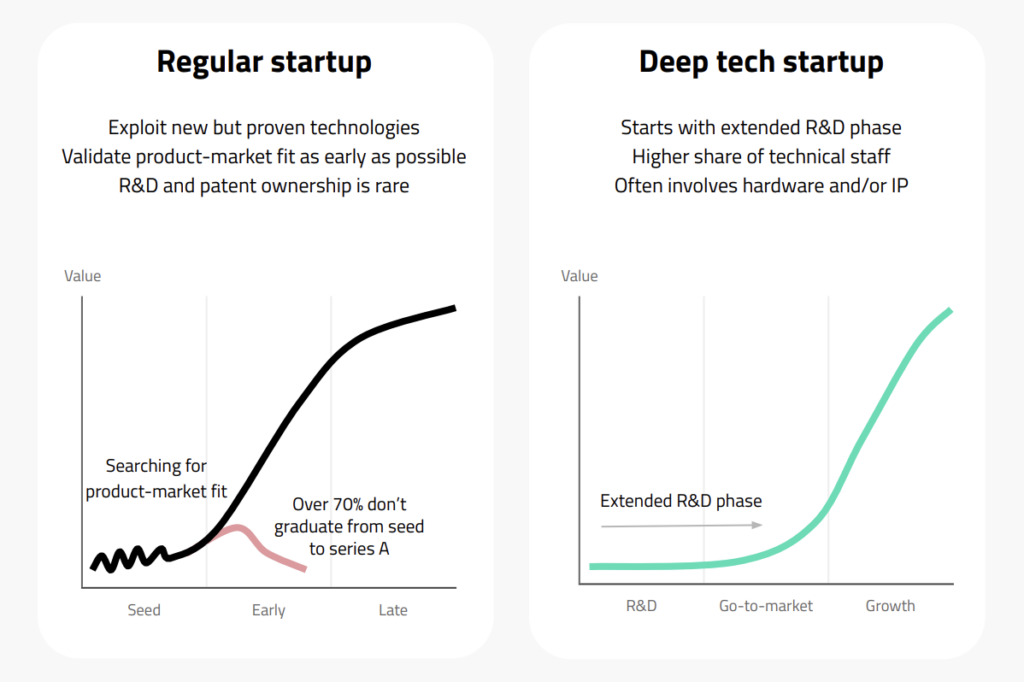

Hello Tomorrow Global Summit is an annual event – hosted in Paris – bringing together deep tech startups, investors and ecosystem supporters. The conference always provides a great opportunity to meet like-minded members of the deep tech community and learn more about the cutting-edge technologies being built today.

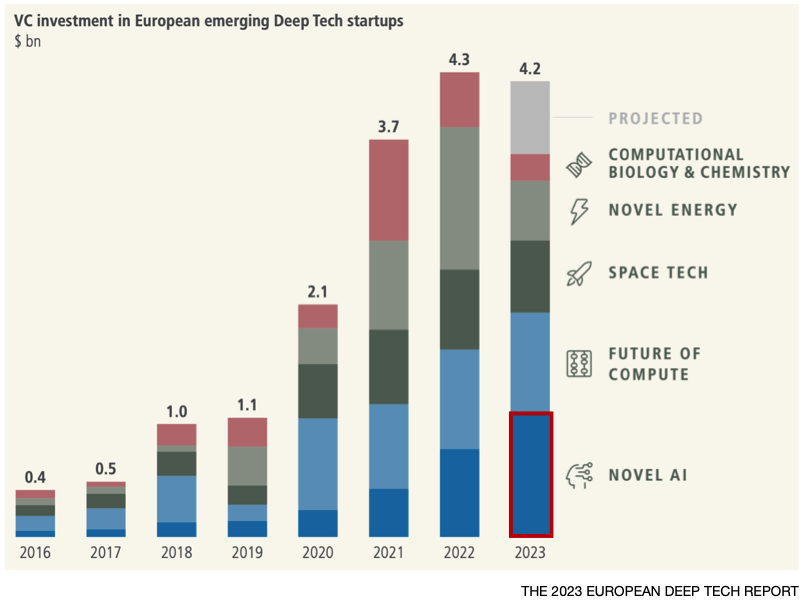

The mood this year was positive, perhaps not surprising given that deep tech is now the biggest sector of VC in Europe, although much debate ensued on how to provide an environment for long-term growth before Europe can consider itself comparable with the US.

Here are five of the most prominent technology areas being discussed and some interesting startups we met within each category.

Data centre tech

There were a number of companies tackling the demand for higher bandwidth and more energy-efficient optical interconnect for data centres: innovative modulation schemes (Phanofi), all-optical transceiver chips (NEW Photonics) and novel end-end optical networking (Astrape Networks).

Novel compute

Whilst there were a handful of companies within the quantum compute space, there were surprisingly few tackling novel compute. Two of note were Literal Labs (formerly Mignon) with their Tsetlin machine approach to AI, and Nanomation, a spinout from Cambridge that has developed novel software for utilising nanomaterials in next-gen chipmaking, neuromorphic computing, quantum applications and biosensing.

Outside of hardware, Embedl are an interesting Swedish startup utilising neural search, pruning and other mechanisms to reduce ML model size for more efficient deployment (and performance) on edge processors.

AR/VR/XR

The AR/VR/XR space remains a target for startups and spinouts from academic research, despite the lacklustre performance of the smartglasses sector to-date (albeit with renewed interested following the launch of Apple’s Vision Pro).

Propositions ranged from Holographic Extended Reality (HXR) projection chips (Swave Photonics) for spatial computing, through ultra-bright laser-based displays enabling better use of smartglasses in sunny conditions (VitreaLab), to SPAE sensors for energy-efficient 3D scene scanning and eye/gaze tracking (VoxelSensors).

Sensing

Sensing in general was a surprisingly well-attended space with a number of deep tech startups covering a wide gamut of industrial and consumer applications.

Multispectral imaging has emerged over the past few years covering a broad range of applications based on the wavelengths supported, and the size and cost of the imaging system.

In many cases, the focus is on industrial applications and replacing (or at least complementing) existing sensing systems (LiDAR, radar, cameras) to improve performance in adverse weather conditions or harsh environments (such as mining), or for use on production lines for spotting anomalies and defects.

Spectricity is unique in this regard by targeting consumer applications in smartphones (e.g., skin health, improved colour photography etc.) as well as industrial applications in agritech and manufacturing.

Elsewhere in sensing, simple RGB camera systems are getting a boost through AI (Tripleye), and companies such as Calyo are demonstrating an ability to deliver ultra-low SWAP-C 3D imaging through novel use of Ultrasound.

3D digital twins

And finally, startups such as Blackshark.AI and AVES Reality are using satellite and other imaging data for generating hyper-realistic 3D representations of the physical world for use across a range of applications including training for autonomous vehicles, digital representations & planning for utility companies, and a number of dual use civil/military applications.

Executive summary

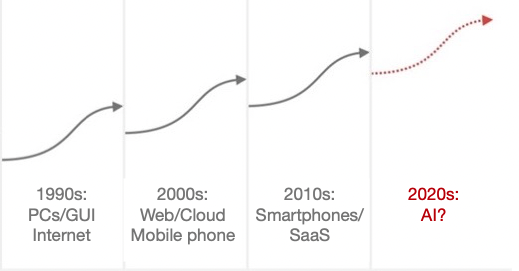

AI has exploded onto the scene, capturing the imagination of the public and investment community alike, and with many seeing it as transformative in driving future economic growth. Certainly, it’s finding its way into all manner of devices and services.

But its thirst for data and generative capabilities across all modalities (text, images, audio, video etc.) will drive a need for a more hyperconnected compute fabric encompassing sensing, connectivity, processing and flexible storage. Addressing these needs will likely be dependent on a paradigm shift away from just connecting things, to enabling “connected intelligence”. Future networks will need to get ‘smarter’, and will likely only achieve this by embracing AI throughout.

Emergence of AI

Whilst AI has been around for 70 years, recent advances in compute combined with the invention of the Transformer ML architecture and an abundance of Internet-generated data has enabled AI performance to advance rapidly; the launch of ChatGPT in particular capturing worldwide public interest in November 2022 and heralding AI’s breakout year in 2023.

Many now regard AI as facilitating the next technological leap forward, and it has been recognised as a crucial technology within the UK Science & Technology Framework.

But how transformative will AI really be?

Sundar Pichai, CEO Alphabet believes “AI will have a more profound impact on humanity than fire, electricity and the internet”, whilst Bill Gates sees it as “the most important advance in technology since the graphical user interface”.

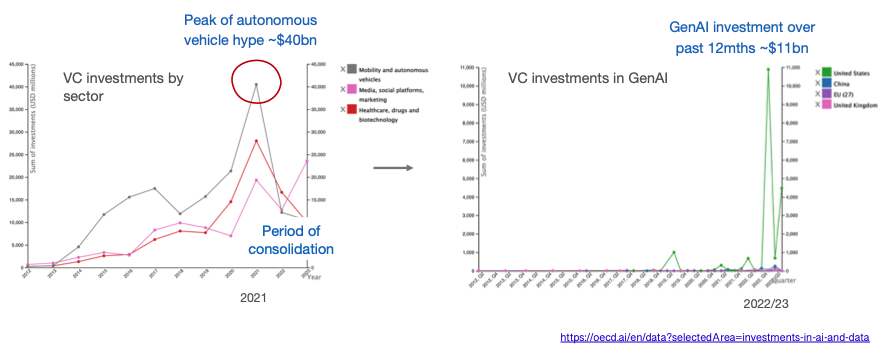

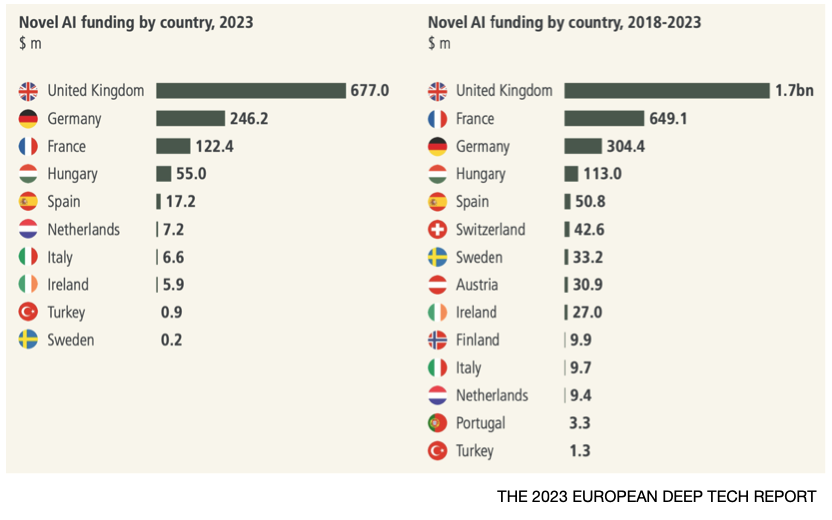

Investor sentiment has also been very positive, AI being the only sector within Deep Tech to increase over the past year, spurred on by the emergence of Generative AI (GenAI).

But is GenAI just another bubble?

The autonomous vehicle sector was in a similar position back in 2021, attracting huge investment at the time but ultimately failing to deliver on expectations.

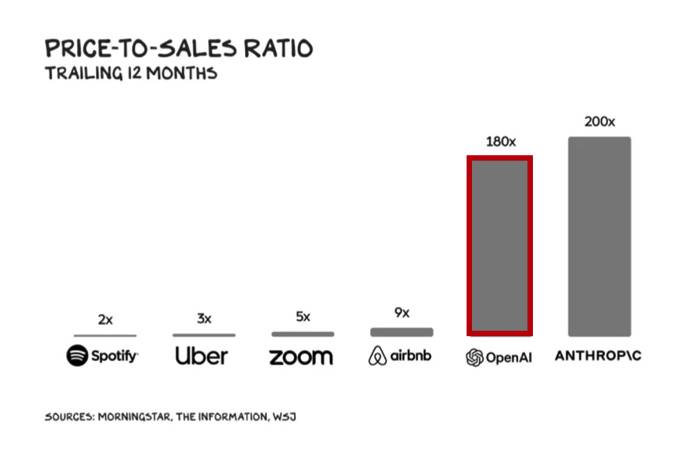

In comparison, commercialisation of GenAI has gotten off to an impressive start with OpenAI surpassing $2bn of annualised revenue and potentially reaching $5 billion+ this year, despite dropping its prices massively as performance improved – GPT3 by 40x; GPT3.5 by 10x with another price reduction recently announced, the third in a year.

On the back of this stellar performance, OpenAI is raising new funding at a $100bn valuation ~62x its forward revenues.

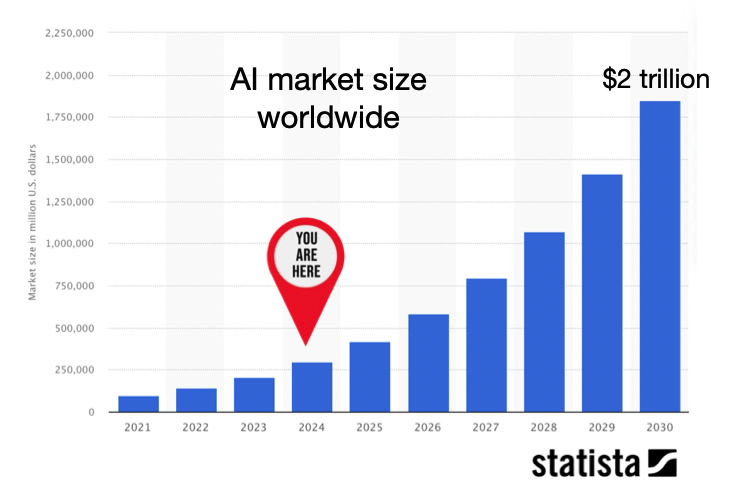

Looking more broadly, the AI industry is forecast to reach $2tn in value by 2030, and contribute more than $15 trillion to the global economy, fuelled to a large extent by the rise of GenAI.

Whilst undeniably value creating, there is concern around AI’s future impact on jobs with the IMF predicting that 40% may be affected, and even higher in advanced economies. Whether this results in substantial job losses remains a point of debate, the European Central Bank concluding that in the face of ongoing development and adoption, “most of AI’s impact on employment and wages – and therefore on growth and equality – has yet to be seen”.

Future services enabled/enhanced by AI

Knowledge workers

GenAI has already shown an impressive ability to create new content (text, pictures, code) thereby automating, augmenting, and accelerating the activities of ‘knowledge workers’.

These capabilities will be applied more widely to the Enterprise in 2024, as discussed in Microsoft’s Future of Work report, and also extend to full multimodality (text, images, video, audio etc.), stimulating an uptick in more spatial and immersive experiences.

Spatial & immersive experiences (XR)

The market for AR/VR headsets has been in decline but likely to get a boost this year with the launch of Meta’s Quest 3 and Apple’s Vision Pro ‘spatial computer’.

Such headsets, combined with AI, enable a range of applications including:

- Enabling teams to collaborate virtually on product development

- Providing information for engineers in the field – e.g., Siemens and Sony

- Simulating realistic scenarios for training purposes (such as healthcare)

- Showcasing products (retail) and enabling new entertainment & gaming experiences

The Metaverse admittedly was over-hyped, but enabling users to “see the world differently” through MR/AR or “see a different world” through VR is expected to boost the global economy by $1.5tn.

Cyber-physical & autonomous systems

Just as AI can help bridge the gap for humans between the physical and the digital, GenAI can also be used to create digital twins for monitoring, simulating and potentially controlling complex physical systems such as machinery.

AI will also be used extensively in robotics and other autonomous systems, enhancing the computer vision and positioning & navigation (SLAM) of smart robots in factories, warehouses, ports, and smart homes with predictions that 80% of humans will engage with them daily by 2030.

Personal devices

And finally, AI is already prevalent in many personal devices; in future, “Language models running on your personal device will become your very personal AI assistant”.

Connected Intelligence

These future services will drive a shift to more data being generated at the edge within end-user devices or in the local networks they interface to.

As the volume and velocity increases, relaying all this data via the cloud for processing becomes inefficient, costly and reduces AI’s effectiveness. Moving AI processing at or near the source of data makes more sense, and brings a number of advantages over cloud-based processing:

- improved responsiveness – vital in smart factories or autonomous vehicles where fast reaction time is mission critical

- increased data autonomy – by retaining data locally thereby complying with data residency laws and mitigating many privacy and security concerns

- minimising data-transfer costs of moving data in/out of the cloud

- performing continuous learning & model adaptation in-situ

Moving AI processing completely into the end-user device may seem ideal, but presents a number of challenges given the high levels of compute and memory required, especially when utilising LLMs to offer personal assistants in-situ.

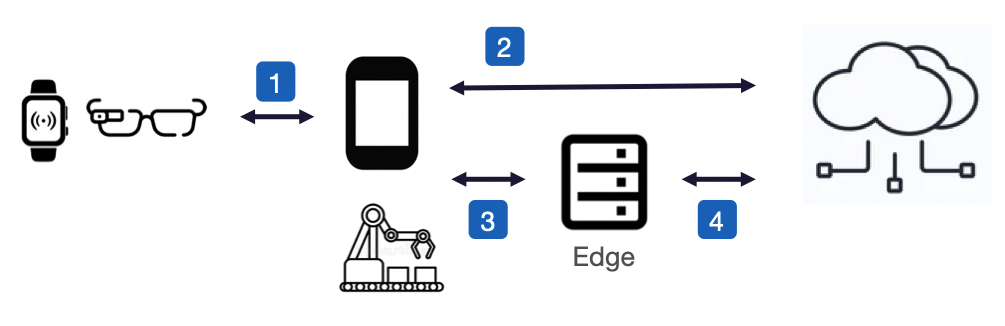

Running AI on end-user devices may therefore not always be practical, or even desirable if the aim is to maximise battery life or support more user-friendly designs, hence AI workloads may need to be offloaded to the best source of compute, or perhaps distributed across several, such as a wearable offloading AI processing to an interconnected smartphone, or a smartphone leveraging compute at the network edge (MEC).

Future networks, enabled by AI

Future networks will need to evolve to support these new compute and connectivity paradigms and the diverse requirements of all the AI-enabled services outlined.

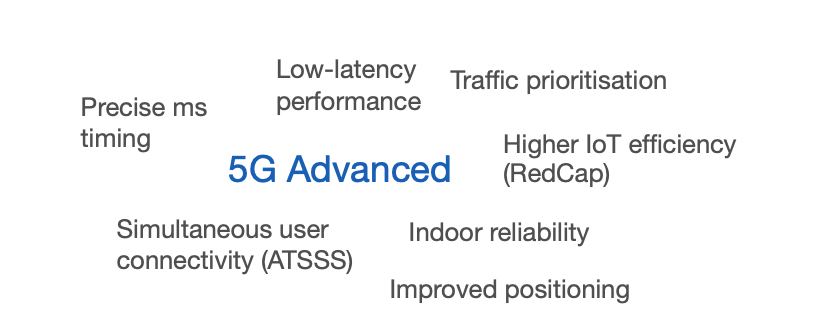

5G Advanced will meet some of the connectivity needs in the near-term, such as low latency performance, precise timing, and simultaneous multi-bearer connectivity. But going forward, telecoms networks will need to become ‘smarter’ as part of a more hyperconnected compute fabric encompassing sensing, connectivity, processing and flexible storage.

Natively supporting AI within the network will be essential to achieving this ‘smartness’, and is also the stated aim for 6G. A few examples:

Hardware design

AI/ML is already used to enhance 5G Advanced baseband processing, but for 6G could potentially design the entire physical layer.

Network planning & configuration

Network planning & configuration is increasing in complexity as networks become more dense and heterogeneous with the move to mmWave, small cells, and deployment of neutral host and private networks. AI can speed up the planning process, and potentially enable administration via natural language prompts (Optimisation by Prompting (OPRO); Google DeepMind).

Network management & optimisation

Network management is similarly challenging given the increasing network density and diversity of application requirements, so will need to evolve from existing rule-based methods to an intent-based approach using AI to analyse traffic data, foresee needs, and manage network infrastructure accordingly with minimal manual intervention.

Net AI, for example, use specialised AI engines to analyse network traffic accurately in realtime, enabling early anomaly detection and efficient control of active radio resources with an ability to optimise energy consumption without compromising customer experience.

AI-driven network analysis can also be used as a more cost-effective alternative to drive-testing, or for asset inspection to predict system failures, spot vulnerabilities, and address them via root cause analysis and resolution.

In future, a cognitive network may achieve a higher level of automation where the human network operator is relieved from network management and configuration tasks altogether.

Network security

With the attack surface potentially increasing massively to 10 million devices/km2 in 6G driven by IoT deployments, AI will be key to effective monitoring of the network for anomalous and suspicious behaviour. It can also perform source code analysis to unearth vulnerabilities prior to release, and thereby help mitigate against supply chain attacks such as experienced by SolarWinds in 2020.

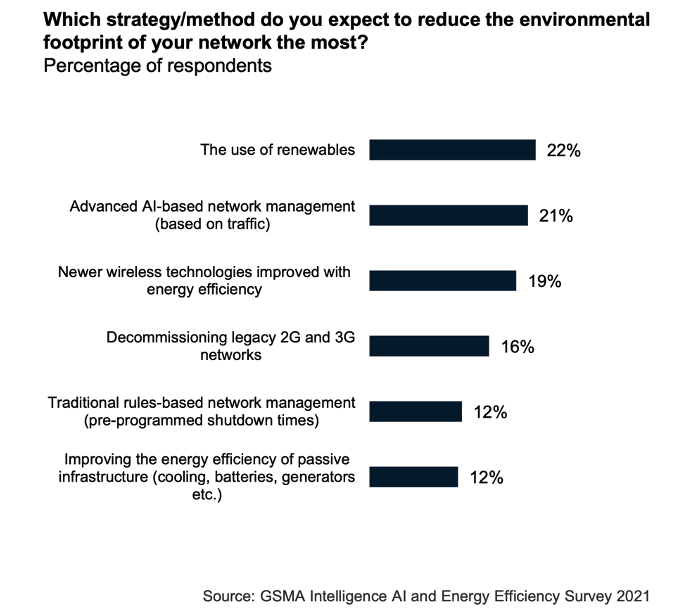

Energy efficiency

Energy consumption can be as high as 40% of a network‘s OPEX, and contribute significantly to an MNO’s overall carbon footprint. With the mobile industry committing to reducing carbon emissions by 2030 in alignment with UN SDG 9, AI-based optimisation in conjunction with renewables is seen as instrumental to achieving this.

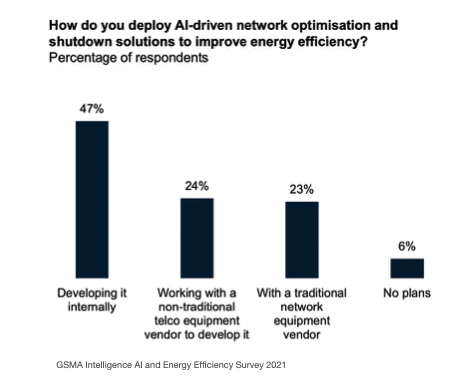

Basestations are the ‘low-hanging fruit’, accounting for 70-80% of total network energy consumption. Through network analysis, AI is able predict future demand and thereby identify where and when parts of the RAN can be temporarily shut down, maintaining the bare-minimum network coverage and reducing energy consumption in the process by 25% without adversely impacting on perceived network performance.

Turkcell, for example, determined that AI was able to reduce network energy consumption by ~63GWh – to put that into context, it’s equivalent to the energy required to train OpenAI’s GPT-4.

Challenges

Applying AI to the operations of the network is not without its challenges.

Insufficient data is one of the biggest constraints, often because passive infrastructure such as diesel generators, rectifiers and AC, and even some network equipment, are not IP-connected to allow access to system logs and external control. Alternatively, there may not be enough data to model all eventualities, or some of the data may remain too privacy sensitive even when anonymised – synthesising data using AI to fill these gaps is one potential solution.

Deploying the AI/ML models themselves also throws up a number of considerations.

Many AI systems are developed and deployed in isolation and hence may inadvertently work against one another; moving to multi-vendor AI-native networks within 6G may compound this issue.

The AI will also need to be explainable, opening up the AI/ML models’ black-box behaviour to make it more intelligible to humans. The Auric framework that AT&T use for automatically configuring basestations is based on decision trees that provide a good trade-off between accuracy and interpretability. Explainability will also be important in uncovering adversarial attacks, either on the model itself, or in attempts to pollute the data to gain some kind of commercial advantage.

Skillset is another issue. Whilst AI skills are transferable into the telecoms industry, system performance will be dependent on deep telco domain knowledge. Many MNOs are experimenting in-house, but it’s likely that AI will only realise its true potential through greater collaboration between the Telco and AI industries; a GSMA project bringing together the Alan Turing Institute and Telenor to improve Telenor’s energy efficiency being a good example.

Perhaps the biggest risk is that the ecosystem fails to become sufficiently open to accommodate 3rd party innovation. A shift to Open RAN principles combined with 6G standardisation, if truly AI-native, may ultimately address this issue and democratise access. Certainly there are a number of projects sponsored within the European Smart Networks and Services Joint Undertaking (SNS JU) such as ORIGAMI that have this open ecosystem goal in mind.

Takeaways

The global economy today is fuelled by knowledge and information, the digital ICT sector growing six times faster than the rest of the economy in the UK – AI will act as a further accelerant.

Achieving its full potential will be dependent on a paradigm shift away from just connecting things, to enabling “connected intelligence”. Future networks will need to get ‘smarter’, and will likely only achieve this by embracing AI throughout.

The UK is a leader in AI investment within Europe; but can it harness this competence to successfully deliver the networks of tomorrow?

The popularity of ChatGPT has introduced the world to large language models (LLMs) and their extraordinary abilities in performing natural language tasks.

According to Accenture, such tasks account for 62% of office workers’ time, and 65% of that could be made more productive through using LLMs to automate or augment Enterprise working practises thereby boosting productivity, innovation, and customer engagement.

To give some examples, LLMs could be integrated into Customer Services to handle product queries, thereby improving response times and customer satisfaction. Equally, LLMs could assist in drafting articles, scripts, or promotional materials, or be used by analysts for summarising vast amounts of information, or gauging market sentiment by analysing customer reviews and feedback.

Whilst potentially disruptive and likely to lead to some job losses (by the mid-2030s, up to 30% of jobs could be automated), this disruption and new way of working is also forecast to grow global revenues by 9%.

It’s perhaps not surprising then that Enterprise executives are showing a keen interest in LLMs and the role they could play in their organisations’ strategies over the next 3 to 5 years.

Large language models such as OpenAI’s GPT-4 or GPT-3.5 (upon which ChatGPT is based) or open source alternatives such as Meta’s recently launched Llama2, are what’s known as foundation models.

Such models are pre-trained on a massive amount of textual data and then tuned through a process of alignment to be performant across a broad range of natural language tasks. Crucially though, their knowledge is limited by the extent of the data they were trained on, and their behaviour is dictated by the approach and objectives employed during the alignment phase.

To put it bluntly, a foundational LLM, whilst exhibiting a dazzling array of natural language skills, is less adept at generating legal documents or summarising medical information, and may be inadequate for those Customer Support applications requiring more empathy, and will certainly lack detailed knowledge on a particular product or business.

To be truly useful therefore, LLMs need to be adapted to the domain and particular use cases where they’ll be employed.

Domain-specific pre-training

One approach would be to collect domain-specific data and train a new model.

However, pre-training your own LLM from scratch is not easy, requiring massive amounts of data, lots of expensive compute hours for training the model, and a dedicated team working on it for weeks or even months. As a result, very few organisations choose this path, although notable examples include BloombergGPT (finance) and Med-PaLM 2 (medicine) and Nvidia have recently launched the NeMo framework to lend a helping hand.

Nonetheless, training a dedicated model is a serious undertaking and only open to those with the necessary resources. For everyone else, an alternate (and arguably easier) approach is to start with an existing foundational model such as GPT-3.5 and fine-tune from there.

Fine-tuning

As a form of transfer learning, fine-tuning adapts the parameters within a foundational model to better perform particular tasks.

Guidance from OpenAI for gpt-3.5-turbo indicates that 50-100 well-crafted examples is usually sufficient to fine-tune a model, although the amount will ultimately depend on the use case.

In comparison to domain-specific pre-trained models which require lots of resource, fine-tuning a foundational model requires less data, costs less, and can be completed in days, putting it well within the reach of many companies.

But it’s not without its drawbacks…

A common misconception is that fine-tuning enables the model to acquire new information, but in reality it only teaches it to perform better within particular tasks, a goal which can also be achieved through careful prompting as we’ll see later.

Fine-tuning also won’t prevent hallucinations that undermine the reliability and trustworthiness of the model’s output; and there is always a risk of introducing biases or inaccuracies into the model via the examples chosen, or inadvertently training it with sensitive information which subsequently leaks out (hence consideration should be given to using synthetic data).

Where support is required for a diverse set of tasks or edge cases within a given domain, relying on fine-tuning alone might result in a model that is too generic, performing poorly against each subtask. In such a situation, individual models may need to be created for each task and updated frequently to stay current and relevant as new knowledge becomes available, hence becoming a resource-intensive and cumbersome endeavour.

Fortunately, there are other techniques that can be employed, either in concert with or replacing fine-tuning entirely – prompt engineering.

Few-shot prompting

Irrespective of how a language model has been pre-trained and whether or not it’s been fine-tuned, the usefulness of its output is directly related to the quality of the prompt it receives. As so aptly put by OpenAI, “GPTs can’t read your mind“.

Although models can perform relatively well when prompted in a zero-shot manner (i.e., comprising just the task description and any input data), they can also be inconsistent, and may try to answer a question by regurgitating random facts or making something up from their training data (i.e., hallucinating) – they might know how words relate statistically, but they don’t know what they mean.

Output can be improved by supplementing the prompt with one or more input/output examples (few-shot) that provide context to the instruction as well as guidance on desired format, style of response and length; this is known as in-context learning (ICL); see below:

The order in which examples are provided can impact a model’s performance, as can the format used. Diversity is also incredibly important, models prompted with a diverse set of examples tending to perform better (although only the larger foundational models such as GPT-4 cope well with examples that diverge too far from what the model was originally pre-trained with).

Retrieval Augmented Generation

A good way of achieving this diversity is to retrieve task-specific examples from domain-specific knowledge sources using frameworks such as LlamaIndex, LangChain, HoneyHive, Lamini or Microsoft’s LLM-AUGMENTER.

Commonly referred to as Retrieval Augmented Generation, this approach ensures that the model has access to the most current and reliable domain-specific facts (rather than the static corpus it was pre-trained with), and users have visibility of the model’s sources thereby enabling its responses to be checked for accuracy.

As so aptly put by IBM Research, “It’s the difference between an open-book and a closed-book exam“, and hence it’s not surprising that LLMs perform much better when provided with external information sources to draw upon.

A straightforward way of implementing the RAG method is via a keyword search to retrieve relevant text chunks from external documentation, but a better approach is to use embeddings.

Put simply, embedding is a process by which the text is tokenised and passed through the LLM to create a numerical representation of the semantic meaning of the words and phrases within the text, and this representation is then be stored in a vector database (such as Pinecone, Weaviate or Chroma).

Upon receiving a query, the RAG system conducts a vector search of the database based on an embedding of the user query, retrieves relevant text chunks based on similarity and appends them to the prompt for feeding into the LLM:

Care though is needed to not overload the prompt with too much information as any increase in the prompt size directly increases the compute, time and cost for the LLM to derive an output (computation increasing quadratically with input length), and also risks exceeding the foundation model’s max prompt window size (and especially so in the case of open source models which typically have much smaller windows).

Whilst providing additional context and task-specific data should reduce the instances of hallucinations, LLMs still struggle with complex arithmetic, common sense, or symbolic reasoning, hence attention is also needed to the way the LLM is instructed to perform the task, an approach known as instruction prompting.

Instruction prompting

Chain of Thought (CoT) is one such technique, explored by Google and OpenAI amongst others, in which the model is directly instructed to follow smaller, intermediate steps towards deriving the final answer. Extending the prompt instruction with a phrase as simple as “Let’s consider step by step…” can have a surprising effect in helping the model to break down the task into steps rather than jumping in with a quick, and often incorrect, answer.

Self-ask is a similar approach in which the model is asked to generate and then answer sub-questions about the input query first (and with the option of farming out these sub-questions to Google Search to retrieve up-to-date answers), before then using this knowledge to compile the final answer (essentially a combination of CoT and RAG).

Yet another technique, Tree of Thoughts (ToT) is similar in generating a solution based on a sequence of individual thoughts, but goes further by allowing multiple reasoning paths to be considered simultaneously (forming a tree of potential thoughts) and exploring each in turn before settling on a final answer.

Whilst proven to be effective, these various instruction prompting techniques take a linear approach that progresses from one thought to the next. Humans think a little differently, following and sometimes combining insights from different chains of thought to arrive at the final answer. This reasoning process can be modelled as a graph structure and forms yet another area of research.

A final technique, which might seem even more peculiar than asking the model to take a stepwise approach (CoT and ToT) is to assign it a “role” or persona within the prompt such as “You are a famous and brilliant mathematician”. Whilst this role based prompting may seem bizarre, it’s actually providing the model with additional context to better understand the question, and has been found surprisingly to produce better answers.

Options & considerations

The previous sections have identified a range of techniques that can be employed to contextualise an LLM to Enterprise tasks, but which should you choose?

The first step is to choose whether to generate your own domain pre-trained model, fine-tune an existing foundational model, or simply rely on prompting at runtime:

There’s more discussion later on around some of the criteria to consider when selecting which foundational model to use…

Fine-tuning may at first seem the most logical path, but requires a careful investment of time and effort, hence sticking with a foundational model and experimenting with the different prompting techniques is often the best place to start, a sentiment echoed by OpenAI in their guidance for GPT.

Choice of which techniques to try will be dependent on the nature of the task:

Good results can often be achieved by employing different prompting techniques in combination:

- Detailed instructions (instruction prompting) – especially where the task involves complex reasoning

- Carefully chosen set of examples (few-shot learning) – to demonstrate the tone, format and length of output that is required

- Supplementary information (in-context learning, RAG & embeddings) – retrieved from domain-specific knowledge sources to provide more context

It’s also about balance – few-shot learning typically consumes a lot of tokens which can be problematic given the limited window size of many LLMs. So rather than guiding the model in terms of desired behaviour via a long set of examples, this can be offset by incorporating a more precise, textual description of what’s required via instruction prompting.

Prompt window size can also be a limitation in domains such as medical and legal which are more likely to require large amounts of information to be provided in the prompt; for instance most research papers (~5-8k tokens) would exceed the window size of the base GPT-3.5 model as well as many of the open source LLMs which typically only support up to 2,000 tokens (~1,500 words).

Choosing a different LLM with a larger window is certainly an option (GPT-4 can extend to 32k tokens), but as mentioned earlier will quadratically increase the amount of compute, time and cost needed to complete the task, hence in such applications it may be more appropriate to fine-tune the LLM, despite the initial outlay.

Model size is yet another factor that needs to be considered. Pre-training a domain-specific LLM, or fine-tuning a small foundational model (such as GPT-3.5 Turbo) can often match or even outperform prompting a larger foundation equivalent (such as GPT-4) whilst being smaller and requiring fewer examples to contextualise the prompt (by up to 90%) and hence cheaper to run.

Of course, fine-tuning and prompt engineering are not mutually exclusive, so there may be some benefit in fine-tuning a model generically for the domain, and then using it to develop solutions for each task via a combination of in-context learning and instruction prompting.

In particular, fine-tuning doesn’t increase domain-level knowledge, so reducing hallucinations might require adopting techniques such as instruction prompting, in-context learning and RAG/embedding, the latter also being beneficial where responses need to be verifiable for legal or regulatory reasons.

Essentially, the choice of approach will very much come down to use case. If the aim is to deliver a natural language search/recommendation capability for use with Enterprise data, a good approach would be to employ semantic embeddings within a RAG framework. Such an approach is highly scalable for dealing with a large database of documents, and able to retrieve more relevant content (via vector search) as well as being more cost-effective than fine-tuning.

Conversely, in the case of a Customer Support chatbot, fine-tuning the model to exhibit the right behaviours and tone of voice will be important, and could then be combined with in-context learning/RAG to ensure the information it has access to is up-to-date.

Choosing a foundational LLM

There are a range of foundational models to choose from with well-known examples coming from OpenAI (GPT-3.5), Google (PaLM 2), Meta (LLama2), Anthropic (Claude 2), Cohere (Command), Databricks (Dolly 2.0), and Israel’s AI21 Labs, plus an increasingly large array of open source variants that have often been fine-tuned towards particular skillsets.

Deployment on-prem provides the Enterprise with more control and privacy, but increasingly a number of players are launching cloud-based solutions that enable Enterprises to fine-tune a model without comprising the privacy of their data (in contrast to the public use of ChatGPT, for example).

OpenAI, for instance, have recently announced availability for fine-tuning on GPT-3.5 Turbo, with GPT-4 coming later this year. For a training file with 100,000 tokens (e.g., 50 examples each with 2000 tokens), the expected cost might be as little as ~$2.40, so experimenting with fine-tuning is certainly within the reach of most Enterprises albeit with the ongoing running costs of using OpenAI’s APIs for utilising the GPT model.

If an Enterprise doesn’t need to fine-tune, OpenAI now offer ChatGPT Enterprise, based on GPT-4, and with an expanded context window (32k tokens), better performance (than the public ChatGPT) and guaranteed security for protecting the Enterprise’s data.

Alternatively, Microsoft have teamed up with Meta to support Llama 2 on Azure and Windows, and for those that prefer more flexibility, Hugging Face has become by far the most popular open source library to train and fine-tune LLMs (and other modalities).

As mentioned previously, players are also bringing to market LLMs pre-trained for use within a particular domain; for example: BloombergGPT for finance; Google’s Med-PaLM-2 for helping clinicians determine medical issues within X-rays and Sec-PaLM which was tweaked for cybersecurity use cases; Salesforce’s XGen-7B family of LLMs for sifting through lengthy documents to extract data insights, or their Einstein GPT (based on ChatGPT) for use with CRM; IBM’s watsonx.ai geospatial foundation model for Earth observation data; AI21 Labs hyper-optimized task-specific models for content management or expert knowledge systems; Harvey AI for generating legal documents etc.

‘Agents’ take the capabilities of LLMs further still by taking a stated goal from the user and combining LLM capabilities with search and other functionality to complete the task – there are a number of open source projects innovating in this area (AutoGPT, AgentGPT, babyagi, JARVIS, HuggingGPT), but also commercial propositions such as Dust.

It’s a busy space… so what are the opportunities (if any) for startups to innovate and claim a slice of the pie?

Uncovering the opportunities

Perhaps not surprisingly given the rapid advancements that have been achieved over the past 12mths, attention in the industry has very much focused on deriving better foundational models and delivering the immense compute resources and data needed to train them, and consequently has created eye-wateringly high barriers for new entrants (Inflection AI recently raising $1.3bn to join the race).

Whilst revenues from offering foundational models and associated services look promising (if you believe the forecasts that OpenAI is set to earn $1bn over the next 12mths), value will also emerge higher up the value stack, building on the shoulders of giants so to speak, and delivering solutions and tools targeted towards specific domains and use cases.

Success at this level will be predicated on domain experience as well as delivering a toolchain or set of SaaS capabilities that enable Enterprises to quickly embrace LLMs, combine them with their data, and generate incremental value and a competitive advantage in their sector.

In stark contrast to the Big Data and AI initiatives in the past that have delivered piecemeal ‘actionable insights’, LLMs have the potential of unlocking comprehensive intelligence, drawing on every documented aspect of a given business, and making it searchable and accessible through natural language by any employee rather than being constrained by the resources of corporate Business Intelligence functions.

But where might startups go hunting for monetisable opportunities?

One potential option is around embeddings – noisy, biased, or poorly-formatted data can lead to suboptimal embeddings resulting in reduced performance, so is a potential micro-area for startups to address: developing a proposition, backed-up with domain-specific experience, and crafting an attractive niche in the value chain helping businesses in targeted sectors.

Another area is around targeted, and potentially personalised, augmentation tools. Whilst the notion of GenAI/LLMs acting as copilots to augment and assist humans is often discussed in relation to software development (GitHub Copilot; StarCoder), it could equally assist workers across a multitude of everyday activities. Language tasks are estimated to account for 62% of office workers’ time, and hence there is in theory huge scope for decomposing these tasks and automating or assisting them using LLM copilots. And just as individuals personalise and customise their productivity tools to best match their individual workflows and sensibilities, the same is likely to apply for LLM copilots.

Many expect that it will turn into an AI gold rush, with those proving commercial value (finding the gold) or delivering the tools to help businesses realise this value (picks & shovels) earning early success and with a chance of selling out to one of the bigger players keen to do a land grab (e.g., Salesforce, Oracle, Microsoft, GCP, AWS etc.) and before the competition catches up.

Defensibility though is likely to be a challenge, at least in the pure sense of protecting IP, and perhaps is reserved for those with access to domain-specific data sets that gives them an edge – Bloomberg, for instance, had the luxury of training their GPT model using their own repository of financial documents spanning forty years (a massive 363 billion tokens).

Takeaways

Foundational LLMs have come a long way, and can be used across a dazzling array of natural language tasks.

And yet when it comes to Enterprise applications, their knowledge is static and therefore out of date, they’re unable to state their source (given the statistical nature of how LLMs produce outputs), and they’re liable to deliver incorrect factual responses (hallucinations).

To do well in an Enterprise setting they need to be provided with detailed and appropriate context, and adequately guided.

Industry and academia are now working diligently to address these needs, and this article has outlined some of the different techniques being developed and employed.

But LLMs are still an immature technology, hence developers and startups that understand the technology in depth are likely to be the ones best able to build more effective applications, and build them faster and more easily, than those who don’t – this, perhaps, is the opportunity for startups.

As stated by OpenAI’s CEO Sam Altman, “Writing a really great prompt for a chatbot persona is an amazingly high-leverage skill and an early example of programming in a little bit of natural language”.

We’re entering the dawn of natural language programming…

Random numbers are used everywhere, from facilitating lotteries, to simulating the weather or behaviour of materials, and ensuring secure data exchange between infrastructure and vehicles in intelligent transport systems (C-ITS).

Perhaps most importantly though, randomness is at the core of the security we all rely upon for transacting safely on the internet. Specifically, random numbers are used in the creation of secure cryptographic keys for encrypting data to safeguard its confidentiality, integrity and authenticity.

Random numbers are provided via random number generators (RNGs) that utilise a source of entropy (randomness) and an algorithm to generate random numbers. A number of RNG types exist based on the method of implementation (e.g. hardware and/or software).

Pseudo-random number generators (PRNGs)

PRNGs that rely purely on software can be cost-effective, but are intrinsically deterministic and given the same seed will produce the exact same sequence of random numbers (and due to memory constraints, this sequence will eventually repeat) – whilst the output of the PRNG may be statistically random, its behaviour is entirely predictable.

An attacker able to guess which PRNG is being used can deduce its state by observing the output sequence and thereby predict each random number – and this can be as small as 624 observations in the case of common PRNGs such as the Mersenne Twister MT19937. Moreover, an unfortunate choice of seed can lead to a short cycle length before the number sequence repeats which again opens the PRNG to attack. In short, PRNGs are inherently vulnerable and far from ideal for cryptography.

True random number generators (TRNGs)

TRNGs extract randomness (entropy) from a physical source and use this to generate a sequence of random numbers that in theory are highly unpredictable. Certainly they address many of the shortcomings of PRNGs, but they’re not perfect either.

In many TRNGs, the entropy source is based on thermal or electrical noise, or jitter in an oscillator, any of which can be manipulated by an attacker able to control the environment in which the TRNG is operating (e.g., temperature, EMF noise or voltage modulation).

Given the need to sample the entropy source, a TRNG can be slow in operation, and fundamentally limited by the nature of the entropy pool – a poorly designed implementation or choice of entropy can result in the entropy pool quickly becoming exhausted. In such a scenario, the TRNG has the choice of either reducing the amount of entropy used for generating each random number (compromising security) or scaling back the number of random numbers it generates.

Either situation could result in the same or similar random numbers being output until the entropy pool is replenished – a serious vulnerability that can be addressed through in-built health checks, but with the risk that output is ceased hence opening the TRNG up to denial-of-service attacks. Ring-oscillator based TRNGs, for instance, have a hard limit in how fast they can be run, and if more entropy is sought by combining a few in parallel they can produce similar outputs hence undermining their usefulness.

IoT devices in particular often have difficulty gathering sufficient entropy during initialisation to generate strong cryptographic keys given the lack of entropy sources in these simple devices, hence can be forced to use hard-coded keys, or seed the RNG from unique (but easy to guess) identifiers such as the device’s MAC address, both of which seriously undermines security robustness.

Ideally, RNGs need an entropy source that is completely unpredictable and chaotic, not influenced by external environmental factors, able to provide random bits in abundance to service a large volume of requests and facilitate stronger keys, and service these requests quickly and at high volume.

Quantum random number generators (QRNGs)

QRNGs are a special class of RNG that utilise Heisenberg’s Uncertainty Principle (an inability to know the position and speed of a photon or electron with perfect accuracy) to provide a pure source of entropy and therefore address all the aforementioned requirements.

Not only do they provide a provably random entropy source based on the laws of physics, QRNGs are also intrinsically high entropy hence able to deliver truly random bit sequences and at high speed thereby enabling QRNGs to run much faster than other TRNGs, and more efficiently than PRNGs across high volume applications.

They are also more resistant to environmental factors, and thereby at less risk from external manipulation, whilst also being able to operate reliably in EMF noisy environments such as data centres for serving random numbers to thousands of servers realtime.

But not all QRNGs are created equal; poor design in the physical construction and/or processing circuitry can compromise randomness or reduce the level of entropy resulting in system failure at high volumes. QRNG designs embracing sophisticated silicon photonics in an attempt to create high entropy sources can become cost prohibitive in comparison to established RNGs, whilst other designs often have size and heat constraints.

Introducing Crypta Labs

Careful design and robustness in implementation is therefore vital – Crypta Labs have been pioneering in quantum technology since 2014 and through their research have developed a unique solution utilising readily available components that makes use of quantum photonics as a source of entropy to produce a state-of-the-art QRNG capable of delivering quantum random numbers at very high speeds and easily integrated into existing systems. Blueshift Memory is an early adopter of the technology, creating a cybersecurity memory solution that will be capable of countering threats from quantum computing.

Rapid advances in compute power are undermining traditional cryptographic approaches and exploiting any weakness; even a slight imperfection in the random number generation can be catastrophic. Migrating to QRNGs reduces this threat and provides resiliency against advances in classical compute and the introduction of basic quantum computers expected over the next few years. In time, quantum computers will advance sufficiently to break the encryption algorithms themselves, but such computers will require tens of millions of physical qubits and therefore are unlikely to materialise for another 10 years or more.

Post-quantum cryptography (PQC) algorithms

In preparation for this quantum future, an activity spearheaded by NIST in the US with input from academia and the private sector (e.g., IBM, ARM, NXP, Infineon) is developing a set of PQC algorithms that will be safe against this threat. A component part of ensuring these PQC algorithms are quantum-safe involves moving to much larger key sizes, hence a dependency on QRNGs able to deliver sufficiently high entropy at scale.

In summary, a transition by hardware manufacturers (servers, firewalls, routers etc.) to incorporate QRNGs at the board level addresses the shortcomings of existing RNGs whilst also providing quantum resilience for the coming decade. Not only are they being adopted by large corporates such as Alibaba, they also form a component part of the White House’s strategy to combat the quantum threat in the US.

Given that QRNGs are superior to other TRNGs, can contribute to future-proofing cryptography for the next decade, and are now cost effective and easy to implement in the case of Crypta Lab’s solution, they really are a no-brainer.

Foreword from David Leftley (CTO)

Light and its compositions has fascinated scientists for more than 2,000 years – from Aristotle to Newton, Young, Hertz and Maxwell et.al. But it was ultimately Einstein, with his photoelectric effect theory, who postulated that light is made up of particles called photons. Einstein is famous for his research on the theory of relativity yet it was his work on theoretically revealing the photoelectric effect based on the light quantum hypothesis that won him the Nobel Prize in physics in 1921.

The photon has many mysterious physical properties such as possessing the dual properties of a wave and a particle. And it was Einstein himself who described things such as entanglement as “spooky”. Learning more about these properties is allowing us to use light more effectively than ever before and applying this knowledge allows us to make significant advances in many new areas of science and technology. To date, photonics has been predominantly applied to communications with the introduction of optical fibre transforming networks as early as the 1960’s. But now we are seeing photonics taking hold in other areas such as computing, AI, sensing and quantum communications.

In the following brief, David Pollington explores the challenges and exposes some of the early stage innovation opportunities that exist in Photonics and these application areas.

The introduction of PICs

Until now, photonics has focused predominantly on enabling high-speed communications, a lucrative market that now tops $10bn just for optical transceivers. But photonics also has application in many other areas ranging from solid-state LiDAR to inertial navigation sensors, spectrometers, refractive index biosensors, quantum computers, and accelerating AI.

This article discusses the merits of using photons rather than electrons with an especial focus on photonic integrated circuits (PICs), the wide range of integrated photonics use cases, the current industry landscape of PICs, and the opportunities for startups to innovate in this space.

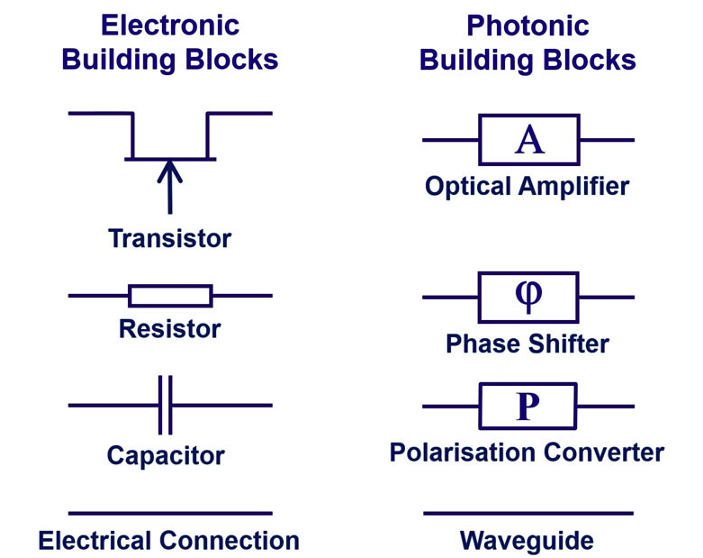

A PIC is a microchip containing photonic components which form a circuit that processes photons as opposed to electrons to perform a function.

In comparison with digital microelectronic circuits in which the majority of functions are performed using transistors, with photonics it’s a little more complex; there’s no single dominant device but rather a variety of components which can be either passive (e.g. couplers, switches, modulators, multiplexers) or active (e.g., amplifiers, detectors, lasers) and then interconnected via waveguides to form a circuit.

Figure 1: Electronic and photonic circuit building blocks [AIP Publishing]

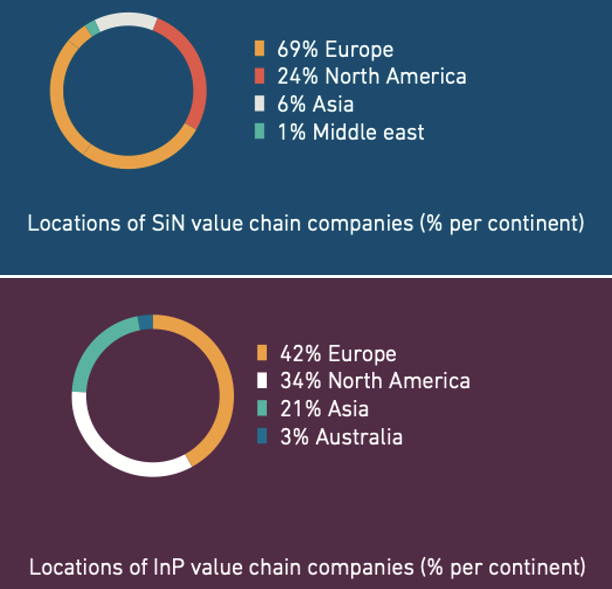

Similar to digital microelectronics, photonic circuits can be fabricated on silicon, enabling high-density PICs to be made in existing CMOS foundries and co-integrated with transistor-based electronics. Silicon on insulator (SOI) has been the most widely used process within silicon photonics (SiPh) but is likely to be replaced in certain applications by Silicon Nitride (SiN) due to its wider spectral range, low propagation loss and higher power handling (particularly useful for detectors, spectrometers, biosensors, and quantum computers).

However, neither of the silicon-based processes can generate light on their own nor allow for the integration of active components, hence a separate process, Indium Phosphide (InP), is commonly used for fabricating high-performance amplifiers, lasers, and detectors.

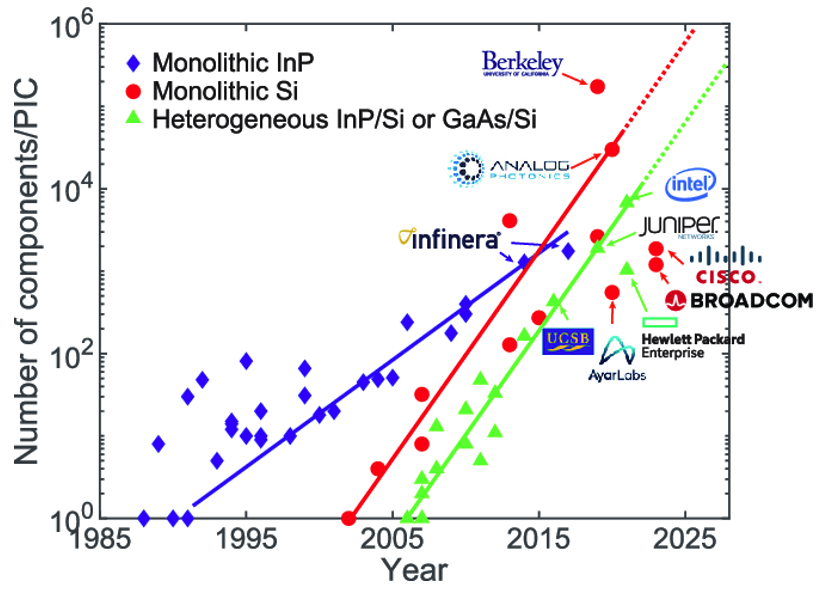

Figure 2: Number of photonic components/PIC [Chao Xiang, University of California]

The design challenges with PICs

Photonic circuit design is complex; individual components need to be tailored to the target application requirements (wavelengths; linearities; power levels), process types (SiPh, InP, SiN) and fabs (characterisation), and hence often need to be designed from scratch, requiring large design teams and/or a dependency on independent design houses.

Once the photonic circuit has been designed and verified there are still hurdles in packaging, laser integration, testing and additional processing steps – whilst packaging, assembly, and testing are only a small part of the cost for digital microelectronics (10%), the reverse is true for photonics, and can be as much as 80% of the total cost for InP photonic devices.

Fabs are starting to address this issue by providing process design kits (PDKs) that designers can use to design, simulate, and verify designs before handing them back to the foundry for fabrication. These PDKs include a base set of photonic building blocks (BBs) to bootstrap the design process but are often limited to particular wavelengths and applications (e.g., telecoms).

A market opportunity therefore exists for design houses and other 3rd parties to license out BBs and even entire circuits that fit the broader set of application requirements. LioniX, for example, offers a range of SiN PIC modules, whilst PhotonDelta, a growth accelerator for the Dutch integrated photonics industry, offers a number of design libraries.

EDA tools can then be used for combining these BBs into photonic circuits whilst facilitating seamless integration of electronic and photonic components in IC designs where needed.

However, as mentioned earlier, these designs still then need to be optimised/characterised for the target process/fab, as imperfections and fluctuations of even a few nanometres can cause scattering or reflections and affect performance. In many respects, the photonic circuit design process is more akin to RF and PCB design than digital microelectronics – mostly analogue, and needing careful selection and qualification of components.

A number of parties are exploring ways of addressing some of these issues and accelerating photonic design. Researchers in Canada, for instance, are using machine learning to predict the precise structure of a photonic component once it’s fabricated to a particular process/fab thereby enabling accurate simulation and optimisation to circumvent the ‘trial and error’ nature of photonic design. Similarly, a startup in the UK, Wave Photonics, has pioneered computational techniques to auto-adapt functional building blocks for different wavelengths, fabs and performance design trade-offs.

Nevertheless, the fabrication process still involves a degree of trial and error today, and it may well be 3-5yrs and require a large number of wafer runs and assemblies before the process is perfected sufficiently to deliver the predictable outcomes required to scale up to larger circuits and high volumes.

The use of photonics in communications & networking

Digital microelectronics has become pervasive, but with the demand for ever-faster compute and higher-bandwidth networking, the interaction of electrons with other particles in the copper wires at these speeds is resulting in higher energy consumption, more heat, and restrictions to performance. Photons don’t suffer from any of these constraints being virtually frictionless and able to travel faster, support higher bandwidths, and be more energy efficient, hence present an intriguing alternative.

Whilst optical links have been introduced within data centres to form high-speed clusters, the wiring within the racks is typically copper, and as processing demands continue to rise, this is creating a bottleneck and issues around both energy consumption and cooling.

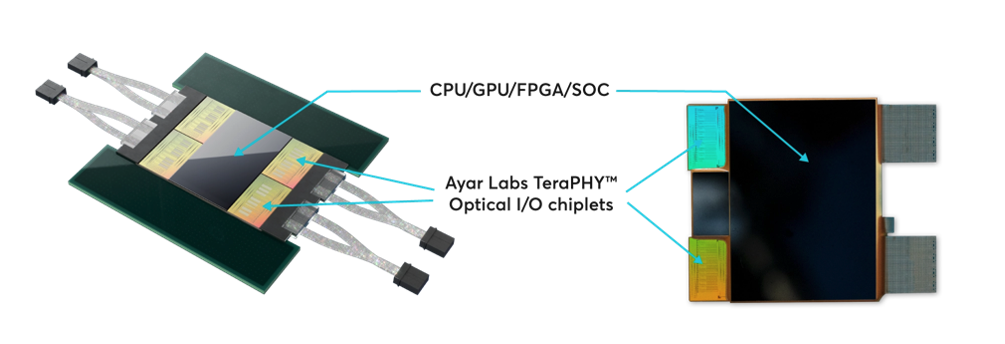

The answer is likely to be through Co-Packaged Optics (CPO) in which the switch ASICs and optical engines are integrated on a single packaged substrate to move the optical connection as close as possible to the switching chip. Doing so enables higher density integration and improves cost effectiveness and energy efficiency with savings of up to 30% of the total system power. Ayar Labs, for example, integrate the optical/electrical components of a transceiver bar the laser inside an optical I/O chiplet.

Figure 3: Ayar Labs optical I/O chiplet [Ayar Labs]

In a similar vein, Nvidia and TSMC are interconnecting multiple AI GPUs via a chip-on-wafer-on-substrate (CoWoS) 2.5D package, and Lightmatter’s Passage enables chiplets to be interconnected via nanophotonic waveguides.

The demand for low-power optical transceivers within data centres, and in particular for Co-Packaged Optics (CPO), will be a key driver in the growth of the silicon photonics market over the next 3-5yrs ($3-4 billion by 2025).

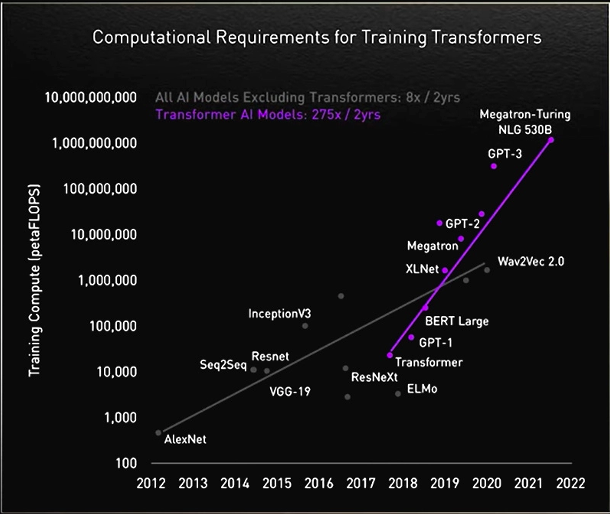

Accelerating AI

With AI compute requirements doubling every 3.4mths (c.f. Moore’s Law which had a 2-year doubling period) [OpenAI] fuelled most recently by the race to generative AI, there is a growing need to develop novel computing systems capable of fast and energy-efficient computation.

Figure 4: Computational requirements for training transformer models [Nvidia]

Silicon photonics may provide an answer, utilising the unique properties of light to solve complex mathematical problems and meet today’s AI compute demands but with energy consumption as low as one photon per operation and performed at the speed of light hence orders of magnitude faster and more energy efficient than digital computation (although getting data efficiently in/out the photonic chip remains a challenge).

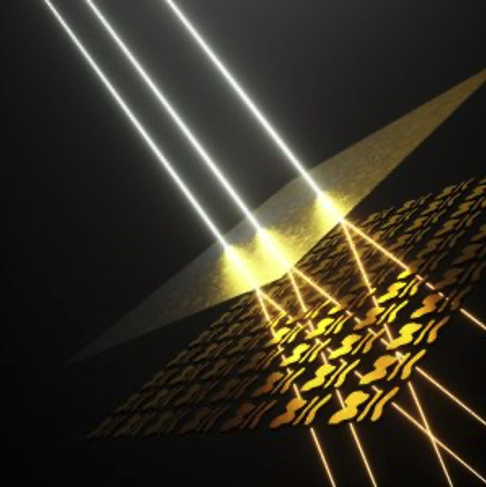

To give an example, detecting edges in an image is of great use in the world of computer vision (e.g., for feature extraction or pattern detection) but requires a lot of compute to perform the CNN multiplication operations.

Figure 5: Example of image edge detection [Brighton Nkomo]

Fourier Transforms (FFT) represent a faster method, enabling the image data to be converted from the spatial domain to the frequency domain where edges will be represented by high frequencies which can be captured via a high pass filter. An inverse FFT then transforms the data back into an image showing just the edges of objects in the original image.

The downside is that FFTs themselves are computationally intensive, so this approach presents only a marginal improvement when using digital computation.

Light though has unique properties, and its interference behaviour can be used to perform FFT operations in a massively parallel way that is not only incredibly fast, but also tremendously energy efficient compared to digital computation.

Figure 6: Solving a complex mathematic equation with light [Ella Maru studio]

In practise though, there remain a few obstacles.

Optical components can’t be packed nearly as tightly as transistors hence chip size can be an issue, although membrane-based nanophotonic technologies should in future enable tens of thousands of components per chip, and new approaches such as the use of very thin nanostructured surfaces combined with semi-transparent mirrors are being explored for performing the matrix multiplications in AI/ML inference.

Another issue is around accuracy. Today’s implementations are mainly targeted at performing inference on ML models trained using digital systems. Physical imperfections in the PIC fabrication, and quantisation noise introduced through the optical/electrical converters for getting data in and out of the photonic chip, can result in a ‘reality gap’ between the trained model and inference output that adversely affects accuracy and energy efficiency.

These challenges though present huge opportunity for innovation, whether that be through improving PIC density, optimising the optical/electrical interface to improve precision, or harnessing the unique properties of light to deliver a step-change in AI inference performance and energy efficiency.

Salience Labs for instance are pioneering a novel ‘on-memory compute’ architecture and using different wavelengths of light to facilitate highly parallelised operation and boost performance, whilst Lumai are exploring the application of photonics for more efficient ML model training.

With the AI chip market projected to be worth a colossal $309bn by 2030 [Verified Market Research], the application of integrated photonics to AI acceleration is likely to attract a lot more investor interest and innovation going forward.

Integrated photonics in sensors

At a component level, integrated photonics is being employed in inertial sensors to achieve ultra-precise positioning/indoor navigation [Zero Point Motion], and separately is enabling laser diodes to be integrated with micro-optics and electrical interfaces on a millimetre-sized chip for use in AR/VR glasses as demonstrated in this YouTube video.

Figure 7: Fully integrated RGB laser light engine for retinal projection in AR [LionIX]

Integrated photonics also opens up the prospect of lab-on-a-chip (LOC) biosensors through a combination of miniaturisation, extreme sensitivity, supporting multiple simultaneous tests, and enabling mass production at low cost. The Point of Care (PoC) market is expected to double in the next few years to $10.1B by 2025 [Yole Development].

Figure 8: Diagnostics platform providing Point of Care (POC) tests [SurfiX Diagnostics]

And finally, the intrinsic benefits in photonics for computing FFTs can also be used to provide the massive vector transforms needed for fast and efficient fully homomorphic encryption (FHE) to enable secure processing in the cloud or by 3rd parties without the data ever being in the clear.

Can integrated photonics reach scale?

The opportunity is clear. But for integrated photonics to thrive and reach million-scale volumes across multiple sectors there will need to be a more comprehensive set of pre-validated design libraries and tools that decouple design from the underlying fabrication and packaging technology to enable a fabless model that attracts new entrants and innovation.

The opportunity for startups is therefore twofold 1) innovating within the design process & toolchain to reduce lead times and improve performance, 2) applying integrated photonics within new products & services in networking, AI acceleration, ultra-sensitive sensors, and healthcare.

Europe has a heritage in photonics, so it’s perhaps not surprising that European research organisations, spinouts and startups are leading the industry.

Figure 9: Value chain companies by geography [PhotonDelta: SiN; InP]

In the photonics design, packaging and testing space, example European companies include Alcyon Photonics, Wave Photonics, Bright Photonics, VLC Photonics, Photon Design, FiconTEC, PhotonDelta and LioniX.

Companies developing photonic chips to accelerate AI include Optalysys, Salience Labs and Lumai whilst those using photonics to produce ultra-sensitive sensors include Zero Point Motion, Miraex and PhotonFirst; SMART Photonics and EFFECT Photonics are addressing the telecoms/networking space, and organisations such as PhotonDelta and JePPIX are helping to coordinate the growth of integrated photonics across Europe.

Integrated photonics faces many challenges, but there is increasing evidence that the technology is set to follow the same trajectory as microelectronics over the coming years. The potential upside is therefore huge, both in terms of market value but also in the opportunity this presents for innovative startups.

If you’re a startup in this space, we’d love to hear from you.

An introduction from our CTO

Whilst security is undoubtedly important, fundamentally it’s a business case based on the time-value depreciation of the asset being protected, which in general leads to a design principle of “it’s good enough” and/or “it will only be broken in a given timeframe”.

At the other extreme, history has given us many examples where reliance on theoretical certainty fails due to unknowns. One such example being the Titanic which was considered by its naval architects as unsinkable. The unknown being the iceberg!

It is a simple fact that weaker randomness leads to weaker encryption, and with the inexorable rise of compute power due to Moore’s law, the barriers to breaking encryption are eroding. And now with the advent of the quantum-era, cyber-crime is about to enter an age in which encryption when done less than perfectly (i.e. lacking true randomness) will no longer be ‘good enough’ and become ever more vulnerable to attack.

In the following, Bloc’s Head of Research David Pollington takes a deeper dive into the landscape of secure communications and how it will need to evolve to combat the threat of the quantum-era. Bloc’s research findings inform decisions on investment opportunities.

Setting the scene

Much has been written on quantum computing’s threat to encryption algorithms used to secure the Internet, and the robustness of public-key cryptography schemes such as RSA and ECDH that are used extensively in internet security protocols such as TLS.

These schemes perform two essential functions: securely exchanging keys for encrypting internet session data, and authenticating the communicating partners to protect the session against Man-in-the-Middle (MITM) attacks.

The security of these approaches relies on either the difficulty of factoring integers (RSA) or calculating discrete logarithms (ECDH). Whilst safe against the ‘classical’ computing capabilities available today, both will succumb to Shor’s algorithm on a sufficiently large quantum computer. In fact, a team of Chinese scientists have already demonstrated an ability to factor integers of 48bits with just 10 qubits using Schnorr’s algorithm in combination with a quantum approximate optimization to speed-up factorisation – projecting forwards, they’ve estimated that 372 qubits may be sufficient to crack today’s RSA-2048 encryption, well within reach over the next few years.

The race is on therefore to find a replacement to the incumbent RSA and ECDH algorithms… and there are two schools of thought: 1) Symmetric encryption + Quantum Key Distribution (QKD), or 2) Post Quantum Cryptography (PQC).

Quantum Key Distribution (QKD)

In contrast to the threat to current public-key algorithms, most symmetric cryptographic algorithms (e.g., AES) and hash functions (e.g., SHA-2) are considered to be secure against attacks by quantum computers.

Whilst Grover’s algorithm running on a quantum computer can speed up attacks against symmetric ciphers (reducing the security robustness by a half), an AES block-cipher using 256-bit keys is currently considered by the UK’s security agency NCSC to be safe from quantum attack, provided that a secure mechanism is in place for sharing the keys between the communicating parties – Quantum Key Distribution (QKD) is one such mechanism.

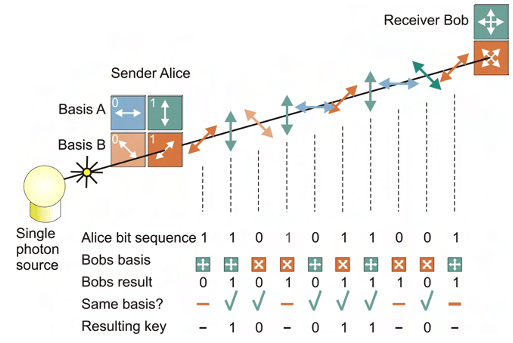

Rather than relying on the security of underlying mathematical problems, QKD is based on the properties of quantum mechanics to mitigate tampering of the keys in transit. QKD uses a stream of single photons to send each quantum state and communicate each bit of the key.

However, there are a number of implementation considerations that affect its suitability:

Integration complexity & cost

- QKD transmits keys using photons hence is reliant on a suitable optical fibre or free-space (satellite) optical link – this adds complexity and cost, precludes use in resource-constrained edge devices (such as mobile phones and IoT devices), and reduces flexibility in applying upgrades or security patches

Distance constraints

- A single QKD link over optical fibre is typically limited to a few 100 km’s with a sweet spot in the 20–50 km range

- Range can be extended using quantum repeaters, but doing so entails additional cost, security risks, and threat of interception as the data is decoded to classical bits before re-encrypting and transmitting via another quantum channel; it also doesn’t scale well for constructing multi-user group networks

- Alternative, greater range can be achieved via satellite links, but at significant additional cost

- A fully connected entanglement-based quantum communication network is theoretically possible without requiring trusted nodes, but is someway off commercialisation and will be dependent again on specialist hardware

Authentication

- A key tenet of public-key schemes is mutual authentication of the communicating parties – QKD doesn’t inherently include this, and hence is reliant on either encapsulating the symmetric key using RSA or ECDH (which, as already discussed, isn’t quantum-safe), or using pre-shared keys exchanged offline (which adds complexity)

- Given that the resulting authenticated channel could then be used in combination with AES for encrypting the session data, to some extent this negates the need for QKD

DoS attack

- The sensitivity of QKD channels to detecting eavesdropping makes them more susceptible to denial of service (DoS) attacks

Post-Quantum Cryptography (PQC)

Rather than replacing existing public key infrastructure, an alternative is to develop more resilient cryptographic algorithms.

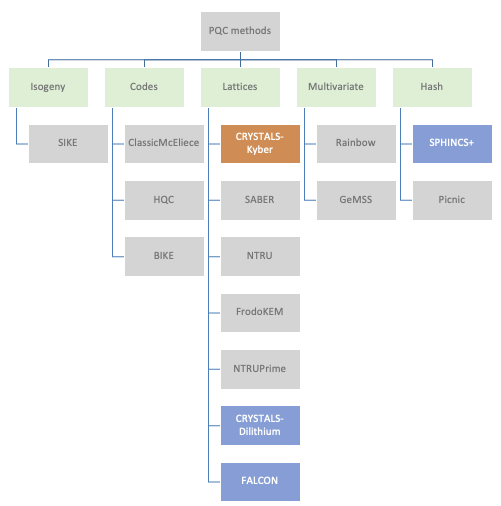

With that in mind, NIST have been running a collaborative activity with input from academia and the private sector (e.g., IBM, ARM, NXP, Infineon) to develop and standardise new algorithms deemed to be quantum-safe.

A number of mathematical approaches have been explored with a large variation in performance. Structured lattice-based cryptography algorithms have emerged as prime candidates for standardisation due to a good balance between security, key sizes, and computational efficiency. Importantly, it has been shown that lattice-based algorithms can be implemented on low-power IoT edge devices (e.g., using Cortex M4) whilst maintaining viable battery runtimes.

Four algorithms have been short-listed by NIST: CRYSTALS-Kyber for key establishment, CRYSTALS-Dilithium for digital signatures, and then two additional digital signature algorithms as fallback (FALCON, and SPHINCS+). SPHINCS+ is a hash-based backup in case serious vulnerabilities are found in the lattice-based approach.

NIST aims to have the PQC algorithms fully standardised by 2024, but have released technical details in the meantime so that security vendors can start working towards developing end-end solutions as well as stress-testing the candidates for any vulnerabilities. A number of companies (e.g., ResQuant, PQShield and those mentioned earlier) have already started developing hardware implementations of the two primary algorithms.

Commercial landscape

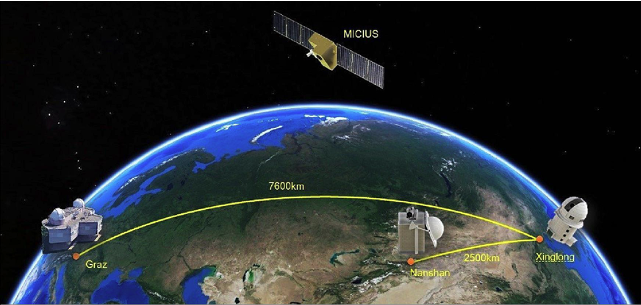

QKD has made slow progress in achieving commercial adoption, partly because of the various implementation concerns outlined above. China has been the most active, the QUESS project in 2016 creating an international QKD satellite channel between China and Vienna, and in 2017 the completion of a 2000km fibre link between Beijing and Shanghai. The original goal of commercialising a European/Asian quantum-encrypted network by 2020 hasn’t materialised, although the European Space Agency is now aiming to launch a quantum satellite in 2024 that will spend three years in orbit testing secure communications technologies.

BT has recently teamed up with EY (and BT’s long term QKD tech partner Toshiba) on a two year trial interconnecting two of EY’s offices in London, and Toshiba themselves have been pushing QKD in the US through a trial with JP Morgan.

Other vendors in this space include ID Quantique (tech provider for many early QKD pilots), UK-based KETS, MagiQ, Qubitekk, Quintessance Labs and QuantumCtek (commercialising QKD in China). An outlier is Arqit; a QKD supporter and strong advocate for symmetric encryption that addresses many of the QKD implementation concerns through its own quantum-safe network and has partnered with Virgin Orbit to launch five QKD satellites, beginning in 2023.