Hello Tomorrow Global Summit is an annual event – hosted in Paris – bringing together deep tech startups, investors and ecosystem supporters. The conference always provides a great opportunity to meet like-minded members of the deep tech community and learn more about the cutting-edge technologies being built today.

The mood this year was positive, perhaps not surprising given that deep tech is now the biggest sector of VC in Europe, although much debate ensued on how to provide an environment for long-term growth before Europe can consider itself comparable with the US.

Here are five of the most prominent technology areas being discussed and some interesting startups we met within each category.

Data centre tech

There were a number of companies tackling the demand for higher bandwidth and more energy-efficient optical interconnect for data centres: innovative modulation schemes (Phanofi), all-optical transceiver chips (NEW Photonics) and novel end-end optical networking (Astrape Networks).

Novel compute

Whilst there were a handful of companies within the quantum compute space, there were surprisingly few tackling novel compute. Two of note were Literal Labs (formerly Mignon) with their Tsetlin machine approach to AI, and Nanomation, a spinout from Cambridge that has developed novel software for utilising nanomaterials in next-gen chipmaking, neuromorphic computing, quantum applications and biosensing.

Outside of hardware, Embedl are an interesting Swedish startup utilising neural search, pruning and other mechanisms to reduce ML model size for more efficient deployment (and performance) on edge processors.

AR/VR/XR

The AR/VR/XR space remains a target for startups and spinouts from academic research, despite the lacklustre performance of the smartglasses sector to-date (albeit with renewed interested following the launch of Apple’s Vision Pro).

Propositions ranged from Holographic Extended Reality (HXR) projection chips (Swave Photonics) for spatial computing, through ultra-bright laser-based displays enabling better use of smartglasses in sunny conditions (VitreaLab), to SPAE sensors for energy-efficient 3D scene scanning and eye/gaze tracking (VoxelSensors).

Sensing

Sensing in general was a surprisingly well-attended space with a number of deep tech startups covering a wide gamut of industrial and consumer applications.

Multispectral imaging has emerged over the past few years covering a broad range of applications based on the wavelengths supported, and the size and cost of the imaging system.

In many cases, the focus is on industrial applications and replacing (or at least complementing) existing sensing systems (LiDAR, radar, cameras) to improve performance in adverse weather conditions or harsh environments (such as mining), or for use on production lines for spotting anomalies and defects.

Spectricity is unique in this regard by targeting consumer applications in smartphones (e.g., skin health, improved colour photography etc.) as well as industrial applications in agritech and manufacturing.

Elsewhere in sensing, simple RGB camera systems are getting a boost through AI (Tripleye), and companies such as Calyo are demonstrating an ability to deliver ultra-low SWAP-C 3D imaging through novel use of Ultrasound.

3D digital twins

And finally, startups such as Blackshark.AI and AVES Reality are using satellite and other imaging data for generating hyper-realistic 3D representations of the physical world for use across a range of applications including training for autonomous vehicles, digital representations & planning for utility companies, and a number of dual use civil/military applications.

A key tenet of the Bloc Ventures investment strategy is to back companies that have science-based IP, with the potential to impact a broad set of industries and so are less affected by hype cycles or momentum.

A proof point of this strategy is AccelerComm, which has today announced a $27m Series B funding round with new investment from Parkwalk, SwissComm and Hostplus, as well as continued support from Bloc Ventures, IP Group and IQ Capital. The confidence shown by the investor community is testament to the technology, the team and the resilient nature of deep tech.

What does AccelerComm do?

Spun-out from the University of Southampton, the company was founded by Professor Rob Maunder and is driven by a leadership team with executive experience gained at ARM, Qualcomm and Ericsson. AccelerComm has established itself as a leader in the optimisation of communication networks, and is already working with Intel, AMD and National Instruments to name a few. When applied to 5G, the company’s world-leading channel coding technology enables the most efficient use of radio spectrum, improving coverage and increasing capacity, whilst reducing latency and power consumption.

What is key to AccelerComm’s success is that they have achieved a strong product-market fit for the technology. Far too often there’s a great idea but no customer. Another fundamental part of the journey (something that we feel is key to spinout success) has been the commitment of the academic founder Rob Maunder, who joined the company on a full-time basis early on its journey.

By applying its technological advancement to a technology economic problem (increasing consumption vs the cost of the network), the company has been able to acquire new customers, demonstrate a growing market and consequently attract growth investors. All this despite the wider less favourable market sentiment towards softer ‘tech’ startups operating in the consumer facing venture capital markets.

Why is deep tech not affected by wider market challenges?

Much has been written about the change in attitude and risk appetite around venture capital investing in recent times, with Michael Casey (Portico Advisors) writing in the FT: “Venture capital prospered in a magical decade that placed a premium value on storytelling”. But in fact, deep tech has been much less affected by this wider sentiment and change in attitude, largely because outlandish storytelling and rapid due diligence, are rarely part of the deep tech investment process.

Of course, deep tech companies come with technical risk, but once this is understood and overcome there only remains market demand risk, and once this is proven, companies often have much more defensibility than more generalist consumer technology companies who are frequently more harshly affected by current market sentiment.

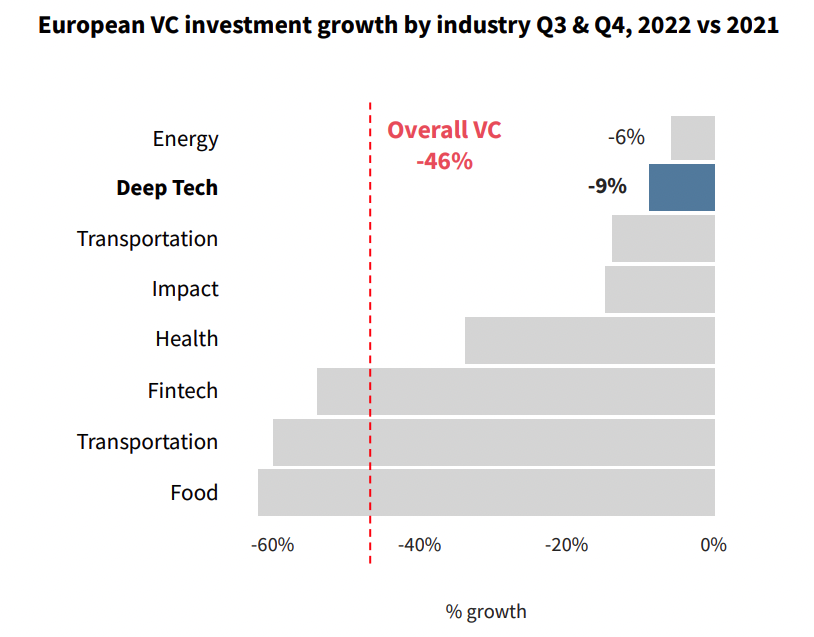

As reported recently by Dealroom, European deep tech funding only dropped 9% from 2021 to 2022, compared with FinTech (45%), Health Tech (35%) and Food Tech (60%) which saw a much larger drop in funding, caused by the wider acknowledgment of inflated valuations in overall VC (which dropped 46% in the same period).

So why doesn’t everyone invest in deep tech?

The ecosystem of deep tech co-investors is relatively small, often with only a handful of options available to entrepreneurs building solutions in complex and specialised markets. There are many reasons for this: the product-market fit journey for deep tech companies can be long and expensive; the technical due diligence involved requires a scientific understanding of the technology; and the network required for an investor to support deep tech companies effectively takes decades to build which is a real barrier for most generalist investors.

These are key reasons behind the way Bloc is structured. We’re a permanent capital company, made up of a complement of deeply technical and operationally experienced industry experts, with a strong network in the technology supply chain. This means we can confidently validate products, companies and entrepreneurs, whilst being able to back them for the long term (with no fund restrictions) and providing hands-on support as portfolio companies commercialise.

The UK ecosystem of deep tech investors is small but growing, with access to some of the best technical minds in the world and the potential to build globally competitive companies like AccelerComm.

So what makes deep tech attractive?

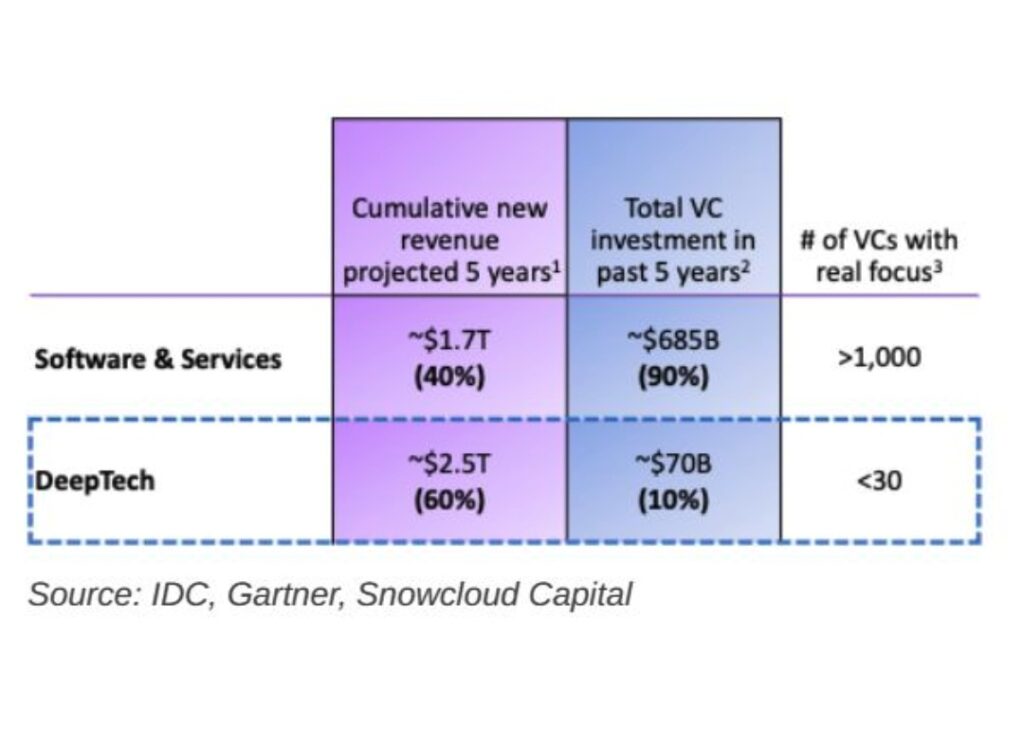

As shown in the table above, as an asset class, despite receiving only 10% of the world’s VC funding, deep tech companies (classified as hardware in the research) are well on a path to punch above their weight in proportion of revenue compared to generalist technology (classified as software in the research). A trend that’s accelerating with the advent of the hard deep tech that AI and Quantum are so reliant on.

The challenge for deep tech startups themselves remains an investor gap with less than 3% of VCs considered to have a real focus on deep tech and the operational expertise and networks necessary to scale them.

At Bloc, we’re always looking for new partners looking to invest in the world’s technology infrastructure, if that’s you please get in touch with our team.

We’re delighted to welcome Vien Phan to the team, who joins Bloc as Chief Operating Officer, as we scale our operations to support fundraising and investment activity.

Vien has nearly 20 years’ experience in finance, strategy and operations roles and is a former Group Head of Strategy for London Stock Exchange Group plc. (“LSEG”). He spent 10 years at LSEG working in Corporate Strategy and Development covering strategic planning, sourcing and screening investment and acquisition opportunities, M&A execution and integrations.

Since leaving LSEG, Vien has spent five years in a variety of advisory and operating roles serving investment firms and technology startups in the FinTech and Life Sciences sectors, with experience in early-stage company fundraising, accounting and operational finance, corporate finance, investment advisory and due diligence.

Vien started his career as a Chartered Accountant with PwC London gaining valuable transaction services and capital markets advisory experience. He holds a Masters in Molecular and Cellular Biochemistry from the University of Oxford. Having served in operating, strategic and advisory roles in both public and private high growth company environments, he brings the ideal and complementary skillset to the Bloc team.

As COO, Vien will work across Bloc’s finance and operations, embedding scalability throughout the company and its portfolio. He commented: “I’m delighted to join Bloc Ventures. It is an investment firm with a differentiated operating model, uniquely deploying patient capital into the early-stage European deep tech digital infrastructure space. The investment team has an impressive track record, a specialist understanding of the sector and provides extensive industry network and operational expertise to the portfolio. Bloc has exciting plans for the future and I’m thrilled to be part of it.”

Bruce Beckloff, CEO at Bloc Ventures, commented: “Vien’s experience over the last 20 years complements the Bloc team incredibly well. He takes our collective operational, financial and strategic expertise to another level and this will be crucial to executing Bloc’s plans for the future. We’re so pleased to have him on board.”

‘A Chat with Bruce Beckloff, CEO at Early-Stage DeepTech Investor: Bloc Ventures’. Bruce is featured in TechRound this week, sharing some of the key focus areas of Bloc and how we support deep tech companies as they take products to market. It was first published on techround.co.uk

The full article can be found here.

‘Investors seek to profit from groundbreaking ‘generative AI’ start-ups. OpenAI’s ChatGPT is part of a rise in sophisticated computer programs that have driven a surge of venture capital interest’

David Leftley was featured in the Financial Times commenting on the rise of generative AI and how it could impact the future of technology as we know it. He specifically commented on the impact of AI on carbon emissions: “We are in a world where companies are chasing net zero [carbon emissions], and the luxury of having chatbots we can talk to through AI is burning a hole through the earth in a data centre.”

The full article can be found here.

We’re so excited to welcome Dr Alisa Molotova to the Bloc Ventures investment team. She is based in Cambridge and will help us discover new deep tech entrepreneurs looking for a specialist investor with Arm and computing as a core part of its DNA.

Alisa has been working in deep science and technology since studying genetics at University of Glasgow (placement as an engineer at GSK) and then completing her PhD (sponsored by Wellcome Trust) in Stem Cell Neuroscience at University of Cambridge, researching at the intersection of biology and physics.

Whilst studying, Alisa became Head of Commercial Strategy at a deep tech startup named Labstep, where she led their business development strategy on their mission to simplify and accelerate scientific discovery. Following her time at Labstep, Alisa moved into the investment world, looking for early-stage technology companies to back on behalf of the investment arm of the University of Cambridge (Cambridge Enterprise).

She focused primarily on Pre-seed and Seed stage investment opportunities, working on all stages of the investment process (including technical due diligence, legal negotiation and board governance), whilst building a strong network in the Cambridge ecosystem. She also organised and judged startup competitions, represented the University in raising a new social innovation fund and mentored underrepresented venture capital candidates to create a fairer and more diverse industry, through Diversity VC.

Alisa then joined Marshall Aerospace and Defence and their newly established in-house accelerator called Marshall Futureworx as a Business Development Executive. As part of the senior management team, she worked on strategic innovation projects and took the lead in developing business cases for investment into emerging technologies across space, air, land and sea for both civilian and military applications. Primarily she focused on unmanned aerial vehicles (UAV), sustainable aviation and energy management.

With experience in business building, world-leading academia, early-stage investing and corporate development, Alisa possesses skills and experience that are core the Bloc DNA and fundamental to the way we operate. Her role at Bloc will be to work alongside our research team to find deep tech investment opportunities and help us grow the Bloc portfolio as we scale.

Alisa commented: “It’s an exciting time for deep tech investing and an equally exciting time to be joining Bloc Ventures on their growth journey. I have always enjoyed working with technologists who are not content with the status quo, and I have found this determination to create change in the Bloc team and the entrepreneurs we back. I’m very excited to get started and start meeting some deep tech companies!”

Outside of her career, Alisa is a registered beekeeper, a keen photographer, long distance runner and speaks four languages. You can meet Alisa and the rest of the Bloc team on 19th May in Cambridge where we’ll be hosting an event titled ‘From PoC to IPO: the journey of a deep tech company’. Sign up here.

Join us on Thursday 19th May at The Bradfield Centre, Cambridge, from 6-9pm.

Description:

This event is designed to provide deep tech founders with the opportunity to gain a better understanding of the journey ahead and meet investors or other entrepreneurs that might be able to support them on the way. Brought to you by Bloc Ventures, Silicon Valley Bank and The Bradfield Centre.

Agenda:

– 6pm: Arrival and refreshments

– 6.30pm: Welcome from Bruce Beckloff, CEO at Bloc Ventures

– 6.40pm: Getting to Series A stage (Chaired by Dr Alisa Molotova)

Panellists: Miles Kirby (Deeptech Labs); Dr Elaine Loukes (Cambridge Enterprise); Rick Hao (Speedinvest); Dr Lee Thornton (IP Group)

– 7.20pm: Getting to Growth stage and beyond (Chaired by Michael Dimelow)

Panellists: Dr Manjari Chandran-Ramesh (Amadeus Capital); Simon King (Octopus Ventures); David Delfassy (Ahren Innovation Capital); Sonya Iovieno (Silicon Valley Bank); Pete Hutton (Cambridge Angels)

– 8pm: Refreshments and networking

– 9pm: Ends

About:

Bloc Ventures is a deep tech investor with a team made up of technologists with experience building globally successful companies like ARM and Vodafone. Typically we invest at Seed to Series A stage in companies across Europe and Israel, focused on cloud, connectivity, data science and security. Our portfolio includes companies in AI, quantum computing and IoT security. Companies can pitch directly to the Bloc investment team.

Silicon Valley Bank. The Bank of Innovation Economy. Our mission is to increase the probability of our clients’ success, by helping innovators, enterprises, and their investors move bold ideas forward fast. We provide a full range of financial services to companies of all sizes in innovation centres around the world. Learn more about Silicon Valley Bank.

We’re delighted to welcome Max Neuberger to the team, who joins Bloc as General Counsel, as we scale our operations to support fundraising and investment capacity.

Max joins Bloc as the fourth key hire of 2021, adding to a Head of Research, Head of Marketing and Finance Manager joining earlier in the year. Max’s role will be to manage legal, regulatory and company secretarial affairs as the company scales, help raise new capital to support deep tech entrepreneurs across Europe and Israel and drive the IPO readiness in anticipation of a 2023 entry to the public markets.

Max joins us from Virgin Group, where he spent eight years working across the group’s portfolio of assets, from large value corporate transactions involving well-known Virgin businesses, to incubating new Virgin businesses, to participating in venture and growth capital investments. Max studied Economics & Management at Oxford University, following which he side-stepped into law and qualified as a solicitor in the Corporate Division of Herbert Smith Freehills, a leading international law firm. He spent five years there advising clients on public and private M&A and company law matters, before moving to Virgin.

As General Counsel, Max will work across all legal elements of Bloc’s operations, including preparing the company as it considers a potential IPO, implementing financial regulatory processes as the company explores raising new forms of capital and overseeing the contractual arrangements with its portfolio companies through their lifecycles. This adds further strength to the firm’s leadership and management, following Andy Green CBE and Sue Prevezer QC’s appointments as Non-Executive Directors earlier in the year.

Max commented “I’m thrilled to join Bloc at this exciting stage, as it looks to raise and deploy significant amounts of venture capital and become a multi-stage investor across the European deep tech ecosystem. A small, ambitious, and hugely talented team is trying to achieve so much in a short space of time. Joining at this pivotal stage, supporting Bloc’s growth and that of its early-stage investment portfolio, is a challenge I’m relishing.”

In addition to Max, we’ve made three more key permanent hires in 2021. David Pollington joined as Head of Research, to support and supplement Bloc’s investment capabilities and understanding of key areas of innovation globally. Ryan Procter joined as Head of Marketing at the beginning of the year to support Bloc’s pipeline growth, investor relations and support portfolio companies as they scale outbound activity. Finally, Richard Yates joined as Finance Manager, taking over responsibility of accounts, future investment modelling and supporting portfolio companies on financial management.

Digimarc and EVRYTHNG unite to build the world’s most powerful product identification engine with the industry’s most advanced product intelligence cloud platform

BEAVERTON, Ore., Nov. 15, 2021 /PRNewswire/ — Digimarc Corporation (NASDAQ: DMRC), creator of Digimarc watermarks that are driving the next generation of digital identification and detection-based solutions, announced today it entered into a definitive agreement to acquire the Product Cloud company EVRYTHNG Limited in a stock transaction.

“This acquisition allows us to provide a complete solution set to our customers,” explains Digimarc CEO Riley McCormack. “The best determinant of a technology product’s value is how much of the customer’s problem it can solve. By combining Digimarc’s unique and advanced means of identification with the pioneer and most advanced supplier of product item business intelligence using any means of identification, we are now uniquely positioned to unlock additional solutions for our customers and enhance their Digimarc journey.”

EVRYTHNG is the market leader and pioneered the Product Cloud category, linking every product item to its Active Digital Identity™ on the web and joining-up product data across the value chain for visibility, validation, real time intelligence, and connection with people.

From enabling more sustainable, more transparent, and more secure supply chains to empowering consumers to verify the authenticity of products and recyclability of their packaging, combining Digimarc’s unique means of identification with the EVRYTHNG Product Cloud® makes it possible to gather and apply traceability data from across the product lifecycle, unlocking end-to-end visibility and authenticity through item-level, real-time intelligence and analytics.

“Not only are our product solutions and technology competencies directly complementary and naturally connected,” explains EVRYTHNG CEO & Co-founder Niall Murphy, “but our company values and cultures are deeply aligned, with a focus on executing as a team, committing to audacious goals, and genuine innovation with exceptional talent. We’re excited to join the Digimarc team to meet important customer needs with product data driven solutions.”

The acquisition expands the geographic footprint for both companies. EVRYTHNG, based in London with offices in New York, Beijing, Minsk, and Lausanne is finding much success in North America. Conversely, Digimarc, based in the Portland, Oregon area, has a growing customer base across Europe.

We’re delighted to announce the appointment of Andy Green CBE as Senior Independent Director and Sue Prevezer QC as Non-Executive Director as we bolster our board of directors ahead of a potential public offering in the future.

Andy Green CBE spent 22 years at BT in leadership roles including as a board member, four years as CEO of Logica (a £4bn turnover business ahead of its acquisition by CGI in 2021) and five years as a NED at Arm (working with Bloc’s CEO, Bruce Beckloff and CCO, Michael Dimelow in the process). He’s held Chairman or NED roles at multiple global technology organisations and has in-depth experience working with public companies. Andy was awarded a CBE in the 2020 New Year’s Honours list for services to the Information Technology Sector and to the British Space Industry.

Sue Prevezer QC has over 25 years of experience arguing large complex commercial cases at every level of the UK judicial system and in arbitration, and has sat as a Deputy High Court Judge in the Chancery Division of the High Court. Until recently, Sue spent 12 years as the Co-Managing Partner of London office of Quinn Emmanuel Urquhart & Sullivan, where her clients included major corporates, funds, investors, trustees, office holders and high net worth individuals, for whom she managed complex, high value, domestic and international litigation. She is also a Non-Executive Director at S4 Capital and Trustee of the Hampstead Theatre and Chair of the Trustees of the Freud Museum. Sue now practices at Brick Court Chambers as a mediator and arbitrator.

Andy and Sue join a board of directors that includes Paul Roy (with over 40 years’ experience in asset management and banking), Stephen Catlin (with over 40 years’ experience in insurance) and Sam Wren (CEO of IPGL and former COO of NEX Group).

Bloc has recently been profiled by research organisation Edison Group as an ‘Expert-led play on early-stage deep tech’, shining a light on the company’s portfolio, investment strategy and key strengths. The Edison report commented on the strength of the management team and their operational experience. Adding Andy and Sue to the board further strengthens Bloc’s leadership team with industry experience. You can read the full report here.

To date, Bloc has raised £28m in balance sheet capital which has been invested into 11 companies across cloud, connectivity, data science and security companies throughout Europe. Each of these companies is fundamentally innovating in their underlying technology to create globally scalable products and solutions Bloc’s intention is to raise new capital in the next 12-18 months ahead of a potential public offering in 2023.

Bruce Beckloff, Co-Founder and CEO of Bloc said: “We are delighted to have Andy and Sue join the Bloc team. Their technology, legal and public company experience further strengthens the board as we work towards a public offering. We place great value in Bloc’s board of directors to not only bring tremendous experience and strategic direction but also their ability to connect our portfolio companies to their valuable network of global businesses”

Andy Green CBE, Senior Independent Director of Bloc, added: “Bloc represents a best-in-class early-stage investor in deep technology across communications and computing. Given my experience with both BT and Arm, this role represents an opportunity for me to add value to the company itself but also the portfolio companies it has invested in. I am very excited to be part of Bloc and am looking forward to the journey we’re about to go on.”

Sue Prevezer QC, Non-Executive Director of Bloc, added: “Building a publicly traded investment company is a challenging journey and takes a significant legal effort to execute correctly. In addition, working with early-stage technology companies adds an exciting dimension to the undertaking and one that I’m delighted to be involved in. Having worked closely with S4 Capital in recent years, I’ve witnessed first-hand the incredible speed that companies and technology can grow across global markets.