The future of AI compute is photonics… or is it?

Exploring the potential of photonics to improve compute efficiency

The mobile industry has been marching to the constant drum beat of defining, standardising and launching the next iteration of mobile technology every ten years or so – 3G launching in 2001, 4G in 2009, 5G in 2019, and now 6G mooted for 2030 if not before.

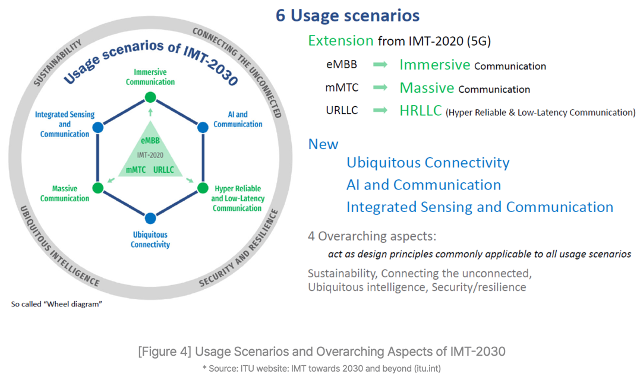

The ITU have laid out a set of 6G goals for the industry to work towards in the IMT-2030 framework. It builds on the existing 5G capabilities, with the aim of 6G delivering immerse, massive, hyper-reliable and low latency communications as well as increasing reach and facilitating connected intelligence & AI services.

In the past, each successive iteration has demanded wholesale upgrades of the network infrastructure – great for the telco equipment manufacturers, but ruinous for the mobile network operators (MNOs).

The GSMA and McKinsey estimate that MNOs worldwide have invested somewhere between $480 billion and $1 trillion respectively to fund the rollout of 5G. And whilst 5G has delivered faster network speeds, there are precious few examples of where 5G has delivered incremental value for the MNOs.

MNOs remain unconvinced that there are any new apps on the horizon that need ‘a new G’, and hence the likes of AT&T, Orangeand SKT amongst others have been vocal about an evolution of 5G rather than yet another step-change with 6G.

This sentiment has been further reinforced by the wider MNO community through NGMN with a clearly stated position that 6G should entail software-based feature upgrades rather than “inherently triggering a hardware refresh”.

The NGMN 6G Position Statement goes on to set a number of MNO-endorsed priorities focused primarily on network simplification with the goal of lowering operational costs, rather than the introduction of whizzy new features.

In particular, it emphasises “automating network operations and orchestration to enable efficient, dynamic service provisioning”, and “proactive network management to predict and address issues before they impact user experience”.

AI will play a pivotal role in achieving these aims. Machine learning (ML) models, for instance, could be trained on a digital twin of the physical environment and then transferred to the network to optimise it for each deployment site, radio condition, and device/user context, thereby improving performance, quality of service (QoS), and network robustness.

AI could also be used to address power consumption, another concern for MNOs, with energy costs representing as much as 40% of a network‘s OPEX according to the GSMA, and now outpacing MNO sales growth by over 50%.

By analysing traffic patterns and other factors, AI is able to make predictions on future traffic demand and thereby identify where parts of the network could be temporarily shut down, reducing energy consumption by 25% and with no adverse impact on the perceived network performance. Turkcell, for example, found that AI was able to reduce their energy consumption by ~63GWh, equivalent to the energy required by OpenAI to train GPT-4.

Startups such as Net.AI have been pioneering in this space, applying AI to improve the energy efficiency of network infrastructure, whilst EkkoSense have recently helped VM O2 save over £1 million a year in the cost of cooling its data centres, and Three have been working with Ericsson to improve energy efficiency by ~70% through the use of AI, data analytics and a ‘Micro Sleep’ feature.

Progressive MNOs such as SKT and Verizon have set out clear strategies for embracing AI, with SKT also teaming up with DT, e&, and Singtel to develop large language models for automating aspects of customer services (Telco LLM) as part of the Global Telco AI Alliance.

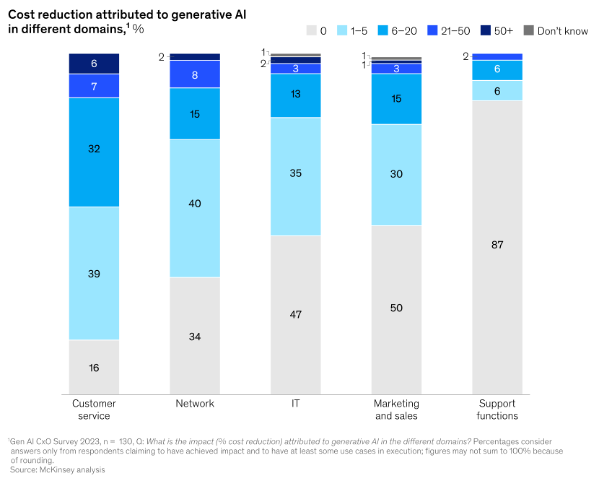

Given its staid image, it may be surprising to learn that telecoms is leading the adoption of GenAI (70%) ahead of both the retail (66%) and banking & insurance (60%) sectors. 89% of telcos plan to invest in GenAI next financial year – the joint highest along with the insurance industry – with application across marketing, sales and IT.

Wider adoption though of AI across all aspects of mobile won’t be easy, and certainly the integration of AI natively into future mobile networks to achieve the desired performance and energy efficiency benefits will present a few challenges.

Naysayers argue that there will be insufficient data to model all network eventualities, and that energy optimisation will be hampered given that much of the passive infrastructure at basestations (power management; air conditioning etc.) is not IP-connected.

Interoperability is another concern, particularly in the early days where AI systems are likely to be developed and deployed independently, hence creating a risk of inadvertently working against each other (e.g., maximising network performance vs shutting down parts of the network to conserve energy).

Other MNOs including Orange baulk at the cost of acquiring sufficient compute to support AI given the current purchasing frenzy around GPUs, and the associated energy cost.

This is likely to be mitigated in the longer term through combining telco and AI compute in an AI-native virtualised network infrastructure. Ericsson, T-Mobile, Softbank, NVIDIA, AWS, ARM, Microsoft, and Samsung have recently joined forces to form the AI-RAN Alliance with the goal of developing AI-integrated RAN solutions, running AI and virtualised network functions on the same compute to boost network efficiency and performance.

NVIDIA and Softbank have already run a successful pilot, demonstrating carrier-grade 5G performance on an Nvidia-accelerated AI-RAN solution whilst using the network’s excess capacity to run AI interference workloads concurrently. In doing so, they were able to unlock the two thirds of network capacity typically running idle outside of peak hours for additional monetisation, effectively turning network base stations from cost centres into AI revenue-producing assets – Nvidia and SoftBank estimate that an MNO could earn ~$5 in AI inference revenue for every $1 capex invested in new AI-RAN infrastructure.

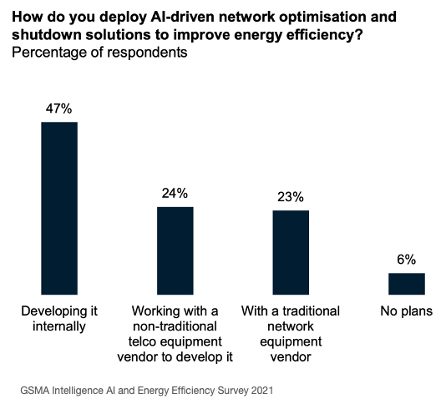

As mentioned earlier, many MNOs are already experimenting with AI across different aspects of their network and operations. To-date, this has typically involved employing in-house resources in limited pilots.

Going forward, it’s likely that AI will only realise its true potential through fostering a closer collaboration between the telecoms and AI sectors (cf. GSMA/ATI 2019), and opening up the network to embrace 3rd party innovation for tackling operational efficiency, a market potentially worth $20 billion by 2030.

This is a contentious issue though; whilst MNOs have been moving gradually towards a more open network architecture through adoption of network function virtualisation and participation in industry initiatives such as O-RAN that target network disaggregation, at an operational level many MNOs still prefer procuring from incumbent suppliers and resist any pressure to diversify their supply chain.

Taking such a stance presents a number of hurdles for startups hoping to innovate in network AI, and worst still, the lack of a validated channel-to-market disincentivises any funding of said startups by VCs.

Elsewhere, there may be other opportunities; for instance, in private 5G where solutions can be curated and optimised for individual Enterprise customers, or in the deployment of neutral host networks at public hotspots run by local councils or at stadiums – a £40m UK Gov initiative is currently underway to fund pilots in these areas.

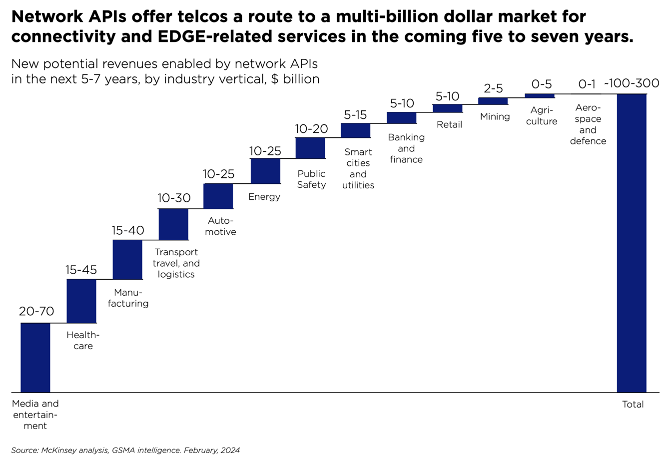

There may also be opportunities to innovate on top of public 5G, leveraging new capabilities such as network slicing to deliver targeted solutions to particular verticals such as broadcasting and gaming, although this hinges on MNO rollout of 5G Standalone, which has been a long time coming, and making these capabilities available to developers via APIs.

MNOs have tried exposing network capabilities commercially many times in the past, either individually or through industry initiatives such as One API Exchange and the Operator Platform Group, but with little success.

MobiledgeX, an edge computing platform spanning 25 MNOs across Europe, APAC and North America was arguably more successful, but eventually acquired and subsumed into Google Cloud in 2022.

Since then, MNOs have progressively come to terms with the need to partner with the Hyperscalers, and more recently Vodafoneand BT amongst others have signed major deals with the likes of Google, Microsoft and AWS.

More interestingly, a collection of leading MNOs (Vodafone; AT&T; Verizon; Bharti Airtel; DT; Orange; Telefonica; Singtel; Reliance Jio; Telstra; T-Mobile US; and America Movil) have recently teamed up with Ericsson and Google Cloud to form a joint venture for exposing industry-wide CAMARA APIs to foster innovation over mobile networks.

If they get it right this time, they may succeed in attracting startups and developers to the telecoms sector, and in doing so unlock a potential $300bn in monetising the network as a platform, as well as expanding their share of the worldwide $5 trillion ICT spend.

Exploring the potential of photonics to improve compute efficiency

Exploring more esoteric approaches to the future of compute