This article was first published on Sifted’s website.

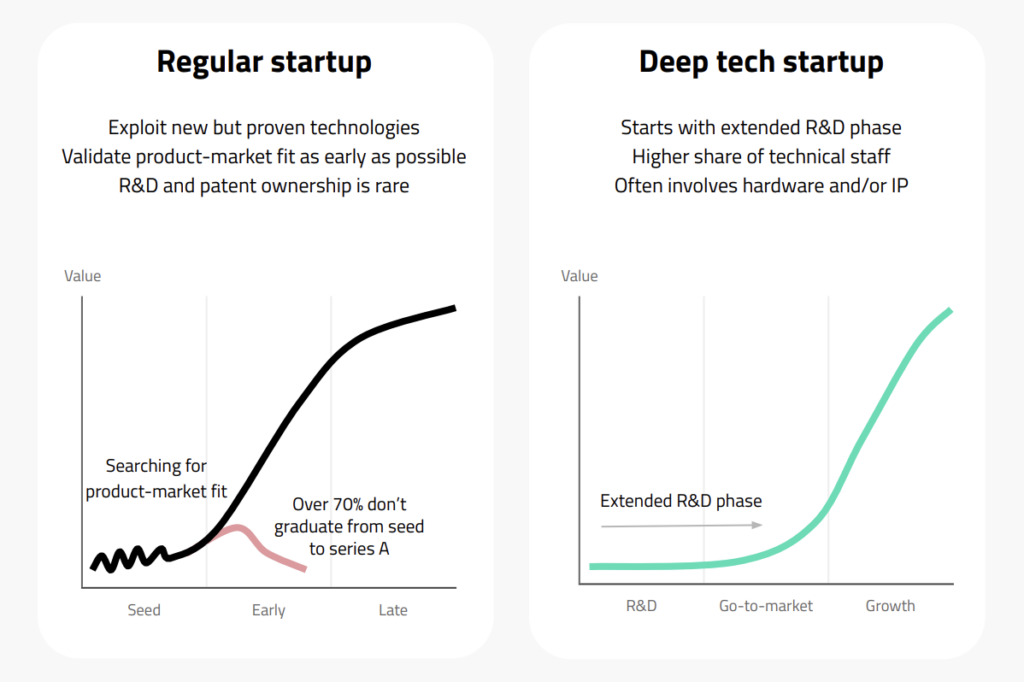

One of the problems that can curtail the growth of an early-stage deep tech startup, and specifically deep tech spinouts, is the length of time it takes to get a product to market — the extended period of research and development (R&D) needed can put off some VCs, who want quicker returns on their cash.

Selling deep tech to customers and potential investors requires shifting focus from the initial scientific discovery to commercial viability, and so at the spinout stage — the process of commercialising research out of a university or similar institution — the company requires entrepreneurial leadership. Without this, it can struggle to survive in a world where corporates and investors are flooded with innovation proposals.

That’s why when it comes to growing and scaling deep tech companies, founding teams need more than world class, deep science — they need entrepreneurial ambition.

Creating the right entrepreneurial environment

Creating the right environment begins with the way an institution approaches the spinout process. An example of how to do this can be seen at imec in Leuven. imec’s model ensures that well before spinning out, the core team is brought together and prepared for the challenges of commercialisation. It does this in several ways:

- An international venturing team spread across Europe and the US supports the company in understanding its market, writing a business plan, attracting talent and ultimately reaching product market fit

- It produces content for startups

- imec’s investors include companies like Philips and Samsung, a direct link to industry which companies can utilise.

imec has a history of spinning out deep techs, and connecting emerging teams with entrepreneurs in its network. It’s spun out 137 companies since 1986, there is a network of investors engaged with its companies from the get-go and it has its own dedicated funds, Fidimec and imec.xpand.

It’s startups include PsiQuantum, which raised a $450m Series D in 2021, and Celestial AI, which raised a $56m Series A earlier this year. Both have relocated to the US to be closer to customers and talent. Radio frequency (RF) semiconductor company Pharrowtech is another spinout from the institution — it raised a €15m Series A in May this year.

Most importantly, imec prepares the company (and the team) for multiple rounds of venture capital funding and puts an emphasis on preserving the right amount of equity for the team, while leaving room for investors to be incentivised for the long road ahead — the amount of equity imec takes at the time of spinning out varies, but this is typically aligned with a lead investor.

A key ingredient for the spinout’s team is also an understanding of what success looks like.

That means having entrepreneurs in and around the company at the spinout stage; speaking to investors or advisors with experience of company building; and having early interactions with “‘teacher customers”, who can enlighten you on their technology roadmap for the future. Potential clients explaining their needs and helping a startup to understand if their innovation meets those needs is invaluable.

What does a good deep tech team look like?

Entrepreneurial ambition and experience are fundamental to taking a technology to market. To improve the odds of achieving global scale, traits like emotional intelligence, extraversion, agreeableness and risk appetite should be present in the leadership team by Series A.

It is worth noting, though, that such traits are unlikely to be present at inception. The founding team should, however, be aware enough to acknowledge and solve that through their hiring process. Members of the core research team need to remain involved in some capacity, being joined by industry experience and commercial talent. Sometimes this means separation from the institution in which the researchers have developed their technology, but not always.

In the case of semiconductor startup AccelerComm, it was spun out from the research of professor Rob Maunder of Southampton University, who is now the CTO and founder. He was joined by commercial leaders from ARM — who he hired after spinning out — providing a mixture of academic rigour and experience selling technology products across the world.

AccelerComm is now approaching its Series B, after a £5.8m Series A in 2020, and Maunder still leads the company’s technology roadmap, while remaining a professor of electronics and computer science at the University of Southampton.

The team growth of AccelerComm is typical of what we’d expect from a deeptech spinout prior to Series A. We would expect a strong technical leader, someone leading on product development and engaging with customers to shape that product, and a CEO who has strong commercial skills but can also communicate well with investors.

Between inception and Series A, it’s vital the company has a product lead to understand customer needs, a CTO to build the technology and a CEO to own investor conversations and oversee sales. We’d expect a deep tech savvy CFO between Series A and B (possibly part-time before the A round), and I’d expect to see the following traits across the leadership team: risk taking, emotional intelligence, extraversion, agreeableness and, above all, transformational leadership (resilience, hope and optimism).

The majority of Bloc’s portfolio companies are deep tech spinouts, we’re always on the look out for more technology teams building the foundations of the future. Get in touch with us here.