The future of AI compute is photonics… or is it?

Exploring the potential of photonics to improve efficiency in the future of compute

A key tenet of the Bloc Ventures investment strategy is to back companies that have science-based IP, with the potential to impact a broad set of industries and so are less affected by hype cycles or momentum.

A proof point of this strategy is AccelerComm, which has today announced a $27m Series B funding round with new investment from Parkwalk, SwissComm and Hostplus, as well as continued support from Bloc Ventures, IP Group and IQ Capital. The confidence shown by the investor community is testament to the technology, the team and the resilient nature of deep tech.

What does AccelerComm do?

Spun-out from the University of Southampton, the company was founded by Professor Rob Maunder and is driven by a leadership team with executive experience gained at ARM, Qualcomm and Ericsson. AccelerComm has established itself as a leader in the optimisation of communication networks, and is already working with Intel, AMD and National Instruments to name a few. When applied to 5G, the company’s world-leading channel coding technology enables the most efficient use of radio spectrum, improving coverage and increasing capacity, whilst reducing latency and power consumption.

What is key to AccelerComm’s success is that they have achieved a strong product-market fit for the technology. Far too often there’s a great idea but no customer. Another fundamental part of the journey (something that we feel is key to spinout success) has been the commitment of the academic founder Rob Maunder, who joined the company on a full-time basis early on its journey.

By applying its technological advancement to a technology economic problem (increasing consumption vs the cost of the network), the company has been able to acquire new customers, demonstrate a growing market and consequently attract growth investors. All this despite the wider less favourable market sentiment towards softer ‘tech’ startups operating in the consumer facing venture capital markets.

Why is deep tech not affected by wider market challenges?

Much has been written about the change in attitude and risk appetite around venture capital investing in recent times, with Michael Casey (Portico Advisors) writing in the FT: “Venture capital prospered in a magical decade that placed a premium value on storytelling”. But in fact, deep tech has been much less affected by this wider sentiment and change in attitude, largely because outlandish storytelling and rapid due diligence, are rarely part of the deep tech investment process.

Of course, deep tech companies come with technical risk, but once this is understood and overcome there only remains market demand risk, and once this is proven, companies often have much more defensibility than more generalist consumer technology companies who are frequently more harshly affected by current market sentiment.

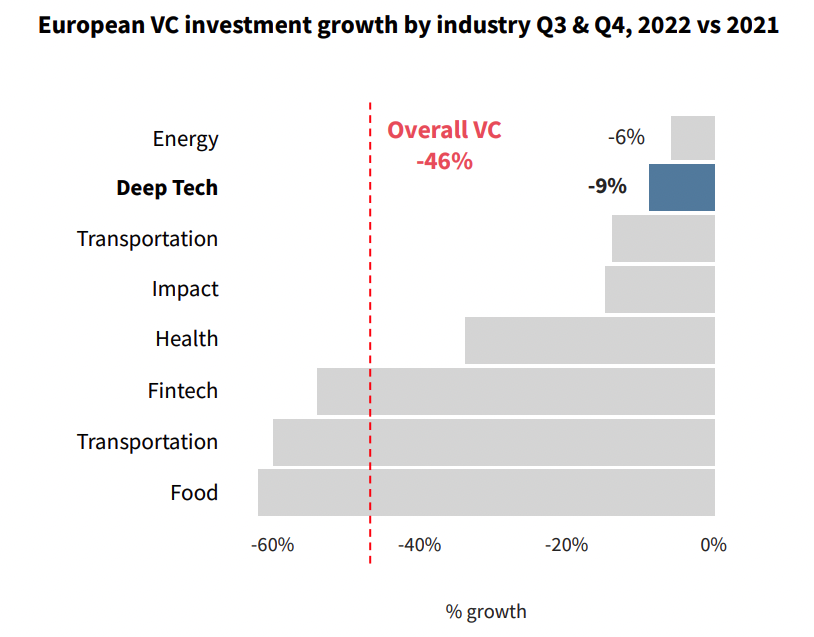

As reported recently by Dealroom, European deep tech funding only dropped 9% from 2021 to 2022, compared with FinTech (45%), Health Tech (35%) and Food Tech (60%) which saw a much larger drop in funding, caused by the wider acknowledgment of inflated valuations in overall VC (which dropped 46% in the same period).

So why doesn’t everyone invest in deep tech?

The ecosystem of deep tech co-investors is relatively small, often with only a handful of options available to entrepreneurs building solutions in complex and specialised markets. There are many reasons for this: the product-market fit journey for deep tech companies can be long and expensive; the technical due diligence involved requires a scientific understanding of the technology; and the network required for an investor to support deep tech companies effectively takes decades to build which is a real barrier for most generalist investors.

These are key reasons behind the way Bloc is structured. We’re a permanent capital company, made up of a complement of deeply technical and operationally experienced industry experts, with a strong network in the technology supply chain. This means we can confidently validate products, companies and entrepreneurs, whilst being able to back them for the long term (with no fund restrictions) and providing hands-on support as portfolio companies commercialise.

The UK ecosystem of deep tech investors is small but growing, with access to some of the best technical minds in the world and the potential to build globally competitive companies like AccelerComm.

So what makes deep tech attractive?

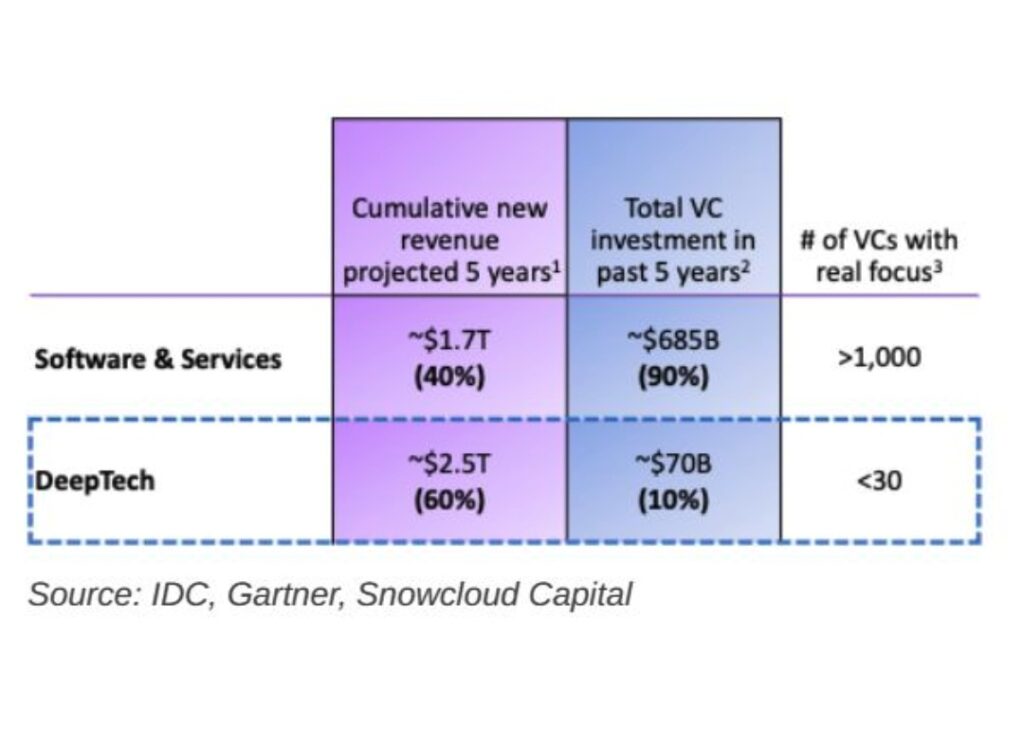

As shown in the table above, as an asset class, despite receiving only 10% of the world’s VC funding, deep tech companies (classified as hardware in the research) are well on a path to punch above their weight in proportion of revenue compared to generalist technology (classified as software in the research). A trend that’s accelerating with the advent of the hard deep tech that AI and Quantum are so reliant on.

The challenge for deep tech startups themselves remains an investor gap with less than 3% of VCs considered to have a real focus on deep tech and the operational expertise and networks necessary to scale them.

At Bloc, we’re always looking for new partners looking to invest in the world’s technology infrastructure, if that’s you please get in touch with our team.

Exploring the potential of photonics to improve efficiency in the future of compute

Exploring more esoteric approaches to the future of compute